Open a bank account

without visiting the bank.

Get your HLB bank account, business account or HLB Wallet online instantly with the Apply@HLB App

Simplified online

account opening

Debit card will be

delivered to your doorstep

Save yourself

a trip to the bank

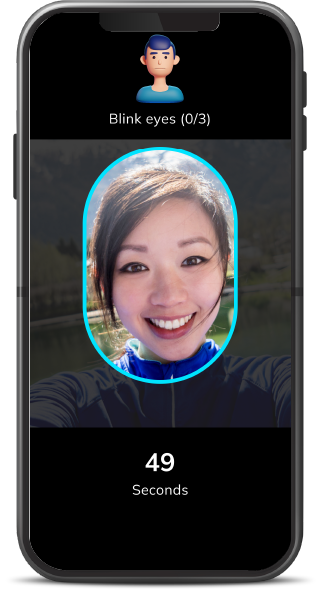

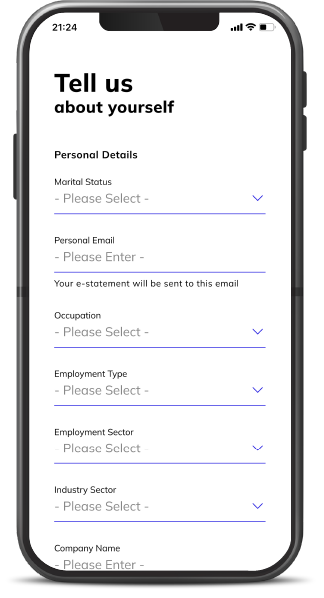

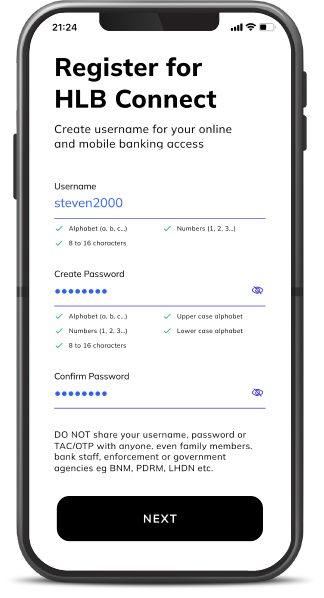

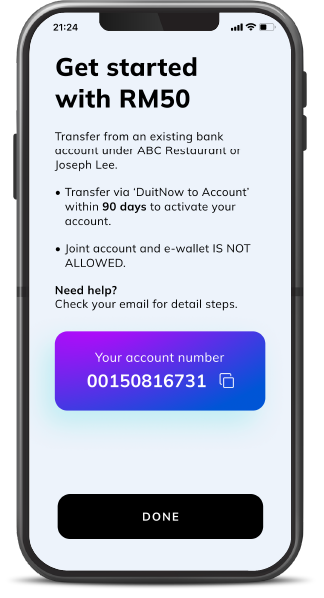

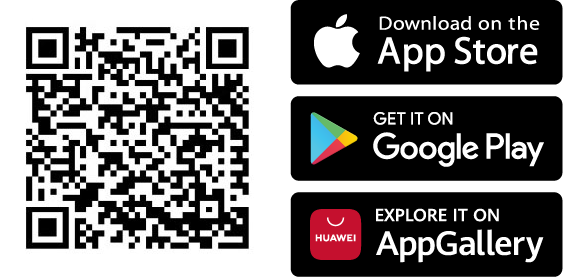

Download the Apply@HLB App & open your HLB bank account online with these easy steps

HLB Wallet

(Coming Soon)

Click on each step to view web screen

Choose an account that best suits your needs

Looking for

instant cashback

Looking for

higher interest

Looking to

grow your business

We offer door-to-door account opening service at selected locations

Make An Appointment >Visit our nearest branch

Locate Branch >If you do not have another existing bank account in Malaysia, please click here and our Deposit Relationship Manager will make an appointment with you to open your first bank account

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

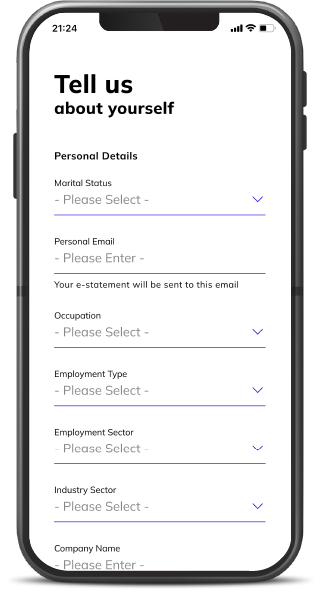

Q1. Who is eligible to apply for HLB bank account online via the Apply@HLB App?

A1. Any Malaysian, aged 18 and above, who have an existing bank account.

Q2. What is the age requirement to apply for an HLB bank account online via the Apply@HLB App?

A2. To apply for an HLB bank account online via the Apply@HLB App you have to be at least 18 years old.

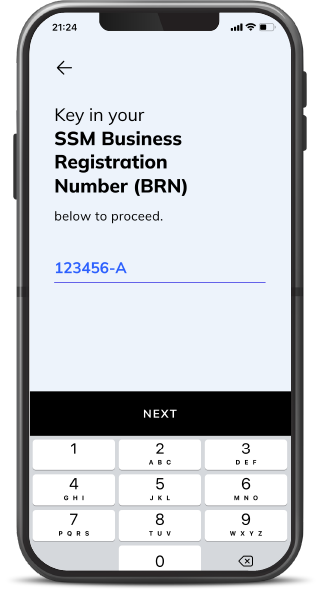

Q3. What are the documents required to apply for an HLB bank account online via the Apply@HLB App?

A3. We only require your MyKad (NRIC). At this moment, other cards such as MyKid, MyPR, MyKAS, MyPolis and MyTentera are not accepted.

Q4. Do I need to complete my online application in one go?

A4. No, you don’t have to. You may choose to leave halfway through and resume your online application later when it’s more convenient for you. Simply ensure the completed application is submitted within fourteen (14) days from the day you first initiated the application online.

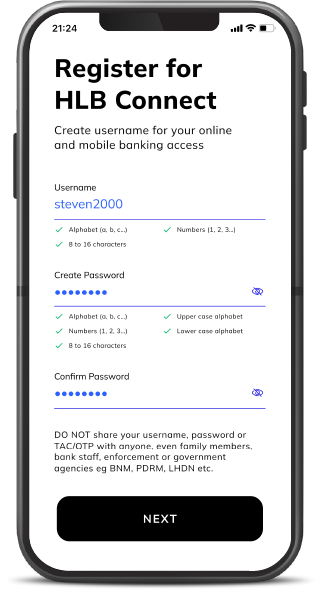

Q5. Can I choose not to set up my HLB Connect online banking username and password when applying for an HLB bank account?

A5. Setting up HLB Connect online banking username and password is part of the online application process. You will need the HLB Connect App/Online to manage your bank account once it’s successfully opened e.g. checking balances, making online payment & transfers and even withdrawing money from HLB ATM using Connect ATM Withdrawal feature while waiting for your debit card to arrive.

Q6. How long will my online application for HLB bank account take?

A6. A notification will be sent to you via an email and SMS to inform you that your online application will be processed within three (3) working days after you have successfully submitted your application.

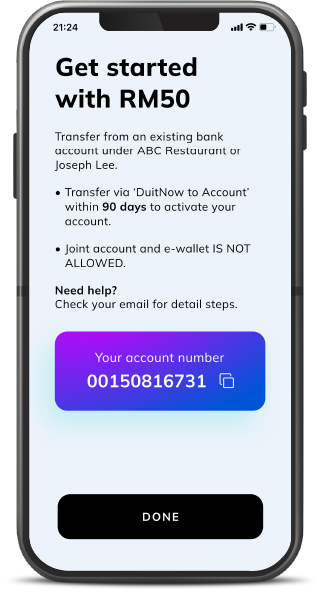

Q7. How do I know that my online application is successful? Will I be receiving any notification to deposit money into my HLB bank account?

A7. You will receive a system generated email and SMS once your online application is successful and to make your first deposit within seven (7) days.

Q8. How do I get my debit card?

A8. You will receive your debit card via post based on the address you have specified in your online application. Your debit card will be delivered to you within fourteen (14) days after you have successfully made the first deposit into your newly opened bank account via an online transfer.

Q9. Can my first deposit into the newly opened account be made via an online transfer from my friend’s/family member’s bank account?

A9. No, the first deposit into your newly opened HLB bank account must be from your own account with another bank (not HLB/HLISB).

Q10. At which point can I start using the username and password which I have created during the online application to access HLB Connect App/Online services?

A10. Once you have successfully made the first deposit into your newly opened bank account, your HLB Connect will be activated within one day. You may log in to HLB Connect App/Online using the username and password you have created during the online application stage.

Q11. Can I withdraw money from my newly opened bank account while waiting for my debit card to arrive?

A11. Yes, you maywithdraw money from your newly opened bank account at any Hong Leong Bank ATMs using the Connect ATM Withdrawal feature available in HLB Connect App. Please download the HLB Connect App and log in using the same username and password created during application. You may want to log in via HLB Connect Online first to set your bank account for transactions and daily spending limit.

Q12. Will I be notified once my HLB Connect is activated?

A12. Yes, you will receive a notification via email and SMS once your HLB Connect is activated.

Q13. How do I activate my debit card?

A13. You may activate your debit card via HLB Connect Online by following these simple steps: Login > click on ‘Other Services’ > click on ‘Activate Card’ under Debit/ATM Card and follow the instructions provided.