These may interest you

Portfolio Type

Model Portfolio – Return Maximizer

One way of achieving optimal results in your investment journey is through building an investment portfolio. A portfolio allows you to diversify investment risks, while optimizing returns regardless of market conditions.

At Hong Leong Bank, we offer a Model Portfolio that will enable you to gain optimal returns according to your risk tolerance.

Our database indicated that you belong to Risk Class 5, hence we believe the Return Maximizer Model Portfolio best suits you. The Return Maximizer Model Portfolio aims to take an aggressive approach to achieve the return in a shorter time span.

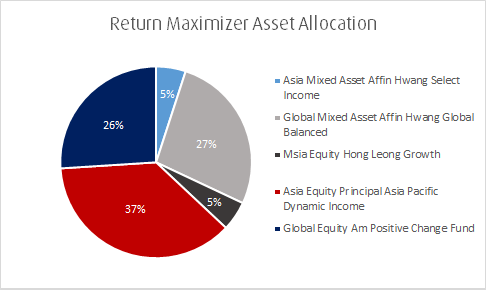

Risk Diversification with Multiple Asset Class

Our Return Maximizer Model Portfolio comprises 80 - 90% equity, while 10 - 20% are made up of bond and cash. You’ll gain investment exposure into:

- Asia Mixed Asset

- Global Mixed Asset

- Malaysia Equity

- Asia Equity

- Global Equity

You’ll gain investment exposure into:

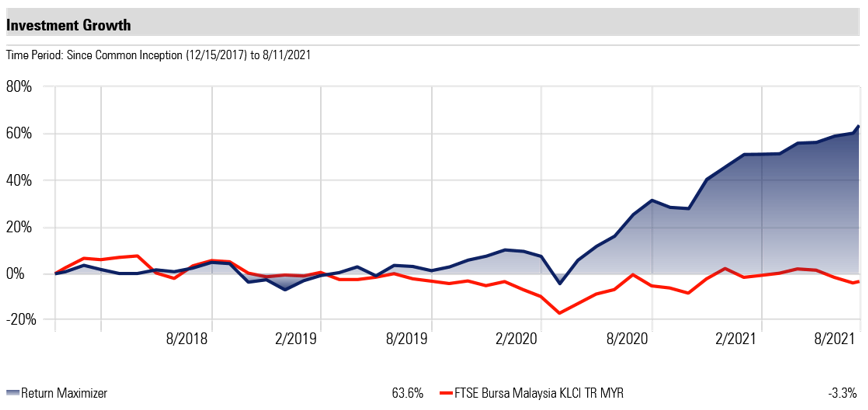

Performance against benchmark

Below are some of the past performance details of our Return Maximizer Model Portfolio.

|

Investment |

Cumulative Return |

Annualized Return |

Max Drawdown |

|---|---|---|---|

| Return Maximizer | 58.85% | 13.79% | -13.16% |

| KLCI | -6.31% | -1.80% | -22.84% |

If you would like to explore further, let us know and our Bank’s representative will get in touch with you very soon.

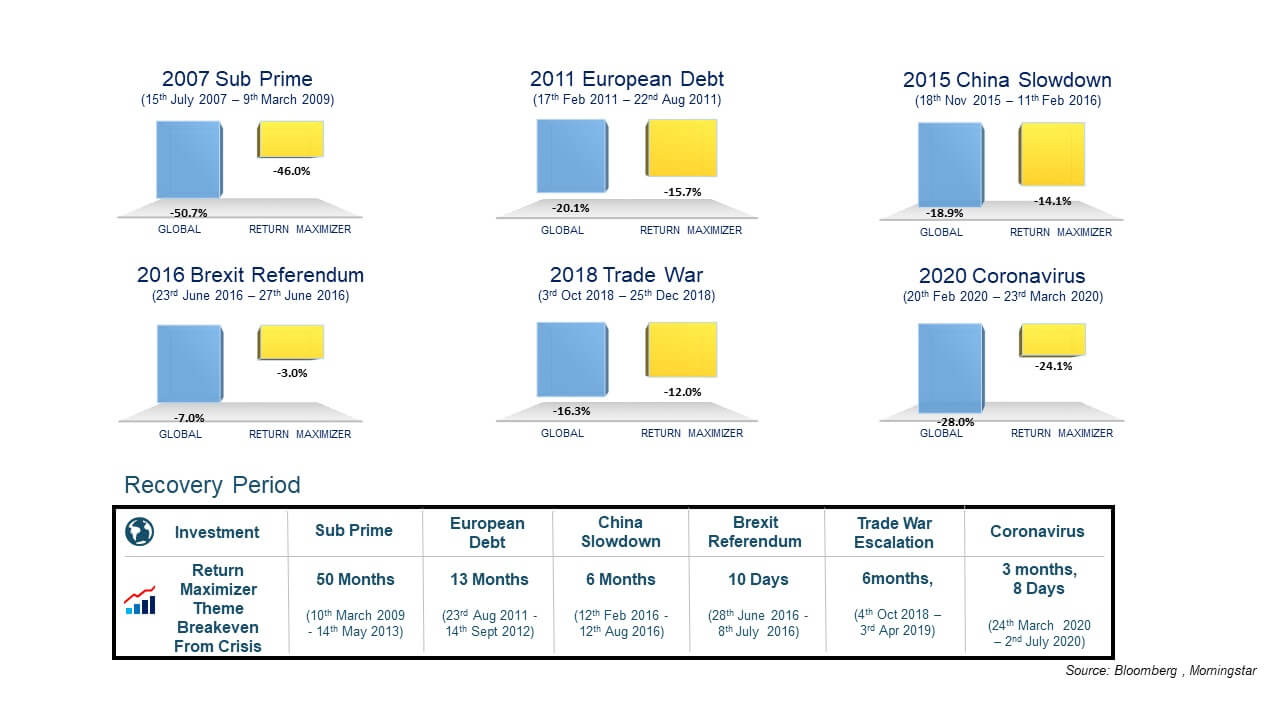

Model Portfolio - Better Risk Management during Crises

Our Model Portfolio can better manage your investment risks during major financial crises.

Our Model Portfolio strategy has lower drawdown through diversification across different asset classes and regions, while optimizing returns efficiently with shorter recovery period and higher overall cumulative return.

Diagrams below show how our Return Maximizer Model Portfolio recovers sooner than other financial markets during a crisis.

Disclaimer: Past performance is not necessarily indicative of future performance and unit prices and investment returns may go down, as well as up.

Our track record has shown that our Model Portfolio is able to consistently generate higher returns compared to its peers, while minimizing drawdowns, resulting in faster recovery post-crisis. This is most evident where our Model Portfolio only took 3 months and 8 days to recover from the Covid-19 crisis.

Based on your current investment holdings, we believe your returns can be further enhanced with our Model Portfolio.

If you would like to explore further, let us know and our Bank’s representative will get in touch with you very soon.

Disclaimers

- This document is not intended to be an invitation or offer for subscription of Unit Trusts nor does it amount to a solicitation by the bank for subscription of Unit Trusts by anyone.

- All facts and figures presented are purely for educational purposes and do not amount to a recommendation.

- Past performance is not necessarily indicative of future performance and unit prices and investment returns may go down, as well as up. Investors should make their own assessment of the risks involved in investing and should seek professional advice, where necessary.

- All facts and figures presented are based on past performance of a specific asset and investment allocation and will change depending on the asset and investment allocation of the individual investor. Investors should make their own assessment of the risks involved in investing and should seek professional advice, where necessary.

- This advertisement has not been reviewed by the Securities Commission.