Features & Benefits

Competitive Instrument

Conduct your investments and business in a highly competitive banking environment with these money market instruments.

More details

Less details

Negotiable Instrument of Deposit is an financial instrument issued by a bank to interbank counterparty to certify that a certain sum in MYR or Foreign Currency has been deposited with the issuing bank. It has a fixed tenor at a specified rate of interest (coupon rate may be fixed, floating or zero). It can be bought or sold to interbank counterparty, but cannot be redeemed before its maturity.

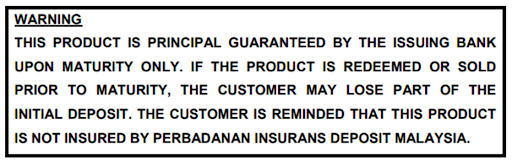

Member of PIDM. NID is not protected by Perbadanan Insurans Deposit Malaysia.

Member of PIDM. NID is not protected by Perbadanan Insurans Deposit Malaysia.

|

Short Term Placement (STP) Indicative Rates (Protected by PIDM up to RM250,000 for each depositor) |

|

|---|---|

|

Overnight |

1.50% |

|

1 Week |

1.55% |

|

2 Weeks |

1.60% |

|

3 Weeks |

1.65% |

|

1 Month |

1.70% |

| Effective from 10 July 2025 | |

Short Term Placement provides an alternative investment avenue for corporate customers to place their excess funds with the bank at a more flexible tenor as compared to the rigid tenor of fixed deposits.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor. Money withdrawn from your insured deposit(s) is no longer protected by PIDM if transferred to a non-deposit account, e.g. Unit Trust, Bond, Dual Currency Investment (DCI), Floating Rate Negotiable Instrument of Deposit (FRNID), Structured Investment, ASNB, Investment Account-i etc.

Click here for STP Terms & Conditions