What's happening to my Ringgit?

Understand FOREX and how it impacts the value of your dollar.

Achieve your financial goals

by investing in Unit Trust,

starting as low as RM50

What is Unit Trust?

Unit trust is an investment pool managed by fund managers licensed by the Securities Commission Malaysia. Investments are typically

charged a one-time fee when they purchase a unit trust and have annual fees to cover the cost of running the fund thereafter.

Unit trust funds can be segregated based on their asset classes. An asset class is a group of investment instruments that

share the same characteristics and regulations.

These funds invest into highly liquid bank deposits and short-term corporate debt instruments. The debt

instruments are typically issued by governments, banks and stronger credit rated corporations. Hence money

market funds have relatively lower risk but provide stable returns.

These funds invest into highly liquid bank deposits and short-term corporate debt instruments. The debt

instruments are typically issued by governments, banks and stronger credit rated corporations. Hence money

market funds have relatively lower risk but provide stable returns.

These funds invest into highly liquid bank deposits and short-term corporate debt instruments. The debt

instruments are typically issued by governments, banks and stronger credit rated corporations. Hence money

market funds have relatively lower risk but provide stable returns.

These funds invest into highly liquid bank deposits and short-term corporate debt instruments. The debt

instruments are typically issued by governments, banks and stronger credit rated corporations. Hence money

market funds have relatively lower risk but provide stable returns.

What are the benefits of investing in Unit Trust?

Affordability

You can start investing in

Unit Trust as low

as RM50.

Professionally-Managed

You get to enjoy the rewards of a Fund

Manager’s expertise and experience,

who will spread out your investments across

asset types and geographies.

Liquidity

You can easily

subscribe units at any

point in time.

Affordability

You can start investing in

Unit Trust as low

as RM50.

Professionally-Managed

You get to enjoy the rewards of a Fund

Manager’s expertise and experience,

who will spread out your investments across

asset types and geographies.

Liquidity

You can easily

subscribe units at any

point in time.

Let's plan out your Financial Goals

Use the Financial Goal Simulator to get a clear picture of what it will take to reach your investment goals.

Your investment goal target amount in

RM0.00

To achieve your investment goal, you have to make a monthly investment of

RM0.00

Quick view on your investment journey

0 years

Your potential returns based on your capital of RM0.00:

Best outcome: RM0.00(+85.89%)

Average outcome: RM0.00(+85.89%)

Worst outcome: RM0.00(+85.89%)

To invest, you will need to have a

Current or Savings Account with us.

Do you have one with us?

How to invest?

Click here to learn more on how you can subscribe to Unit Trust

via HLB Connect Online

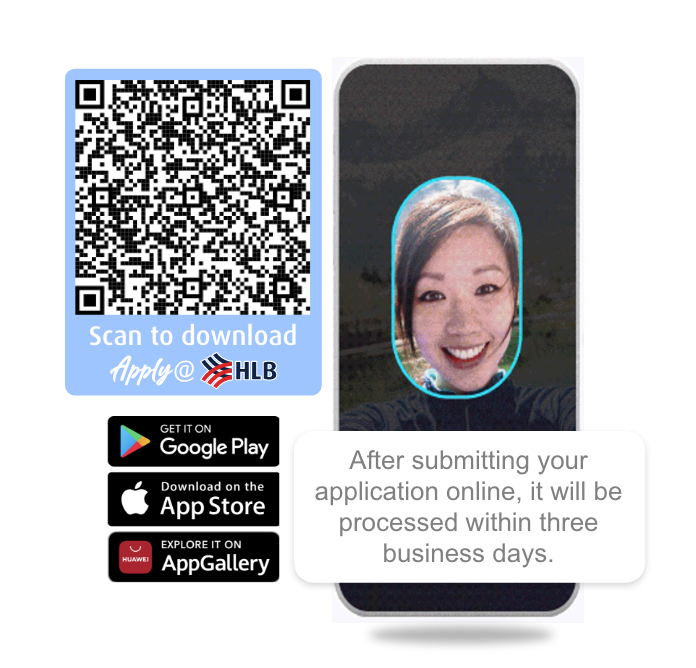

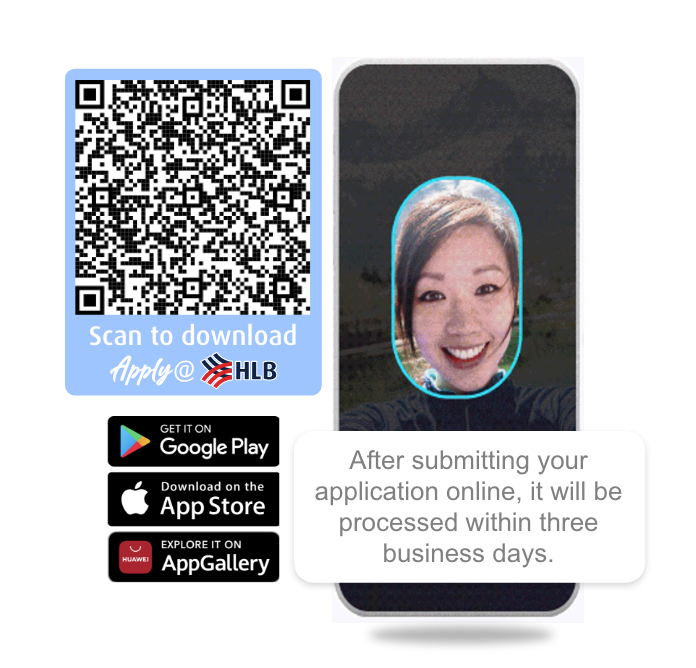

How to apply?

Frequently Asked Questions

The returns on Unit Trust investments are not guaranteed. Unit trust do not constitute bank deposits or obligations nor guaranteed by the bank and are subject to investment risk, including possible loss of principal amount invested.

Your insured deposit(s) will no longer be protected by PIDM if transferred to non-PIDM covered institutions or accounts such as Unit Trusts.

Because unit trusts are easily liquidated, unit holders may redeem all or part of their units on any business day and the unit trust manager will purchase them. This means that should you need cash, you can easily sell the investment. Most unit trusts will allow you to redeem your investments on any given business day. However, keep in mind that you might make a loss in the event that the Unit Trust is sold at a lower price compared to the point of purchase (prices of Unit Trust may shift upwards or downwards depending on the value of the assets they carry).

Disclaimer

Learn, invest and grow with

Fresh Take - your one-stop hub for investment knowledge

Here is some information to help you get started...

Unit Trust Funds of Focus

Gains insights on the funds of focus curated by our team of experts based on the latest economic views

and where potential money-making opportunities are.

To invest, you will need to have a

Current or Savings Account with us.

Do you have one with us?

How to invest?

Click here to learn more on how you can subscribe to Unit Trust

via HLB Connect Online

How to apply?

Frequently Asked Questions

Disclaimer

Warning:

This document is not intended to be an invitation or offer for subscription of Unit Trusts nor does it amount to a solicitation by the bank for subscription of Unit Trusts by anyone. Investors are advised to read and understand the contents of the prospectus before investing. Investors should note that there are fees and charges involved in the purchase of Unit Trusts. Investors are advised to consider the fees and charges involved before investing and consult their licensed financial or other professional advisors, if in doubt about any feature or nature of the fund. Please note, the price of units and dividends payable, if any, may go up or down. Past performance of a fund is not an indicator of its future performance. The returns on Unit Trust investments are not guaranteed and Unit Trusts do not constitute bank deposits or obligations nor guaranteed by the bank and are subject to investment risks, including the possible loss of principal amount invested. Unit Trusts Schemes are not protected by Perbadanan Insurans Deposit Malaysia (PIDM).

All information provided above is for reference only. While all reasonable efforts have been made to ensure that the information provided is accurate and up-to-date, the Bank does not warrant or guarantee the accuracy, completeness or timeliness of the information or data provided. Neither the Bank nor its information providers shall be held responsible or liable for any errors, delays or inaccuracy of the price, data or information provided herein nor for any loss or damage arising directly or indirectly from any action taken in reliance on the information provided herein.

Money withdrawn from your insured deposit(s) is no longer protected by PIDM if transferred to a non-deposit account. eg. Unit Trust, Bond, Dual Currency Investment (DCI), Negotiable Instrument of Deposit (NID) and Floating Rate Negotiable Instrument of Deposit (FRNID), Structured Investment, ASNB, Investment Account-i etc.