Simplicity

Use easy technique to buffer

against wide price fluctuations

and long-term cost of investing

Encourage discipline

Maintain regular investments

despite market conditions to

continue building your portfolio

Start or top up today from HLB Connect Online or

Walk into any HLB Branch to subscribe

Easy set-up

Walk into any HLB branch

and subscribe to this Plan

Track your investment

Monitor and keep updated on

your investment value via

HLB Connect

Set your smart investment plan today on HLB Connect Online!

Make an appointment with us and start your

smart investment plan today!

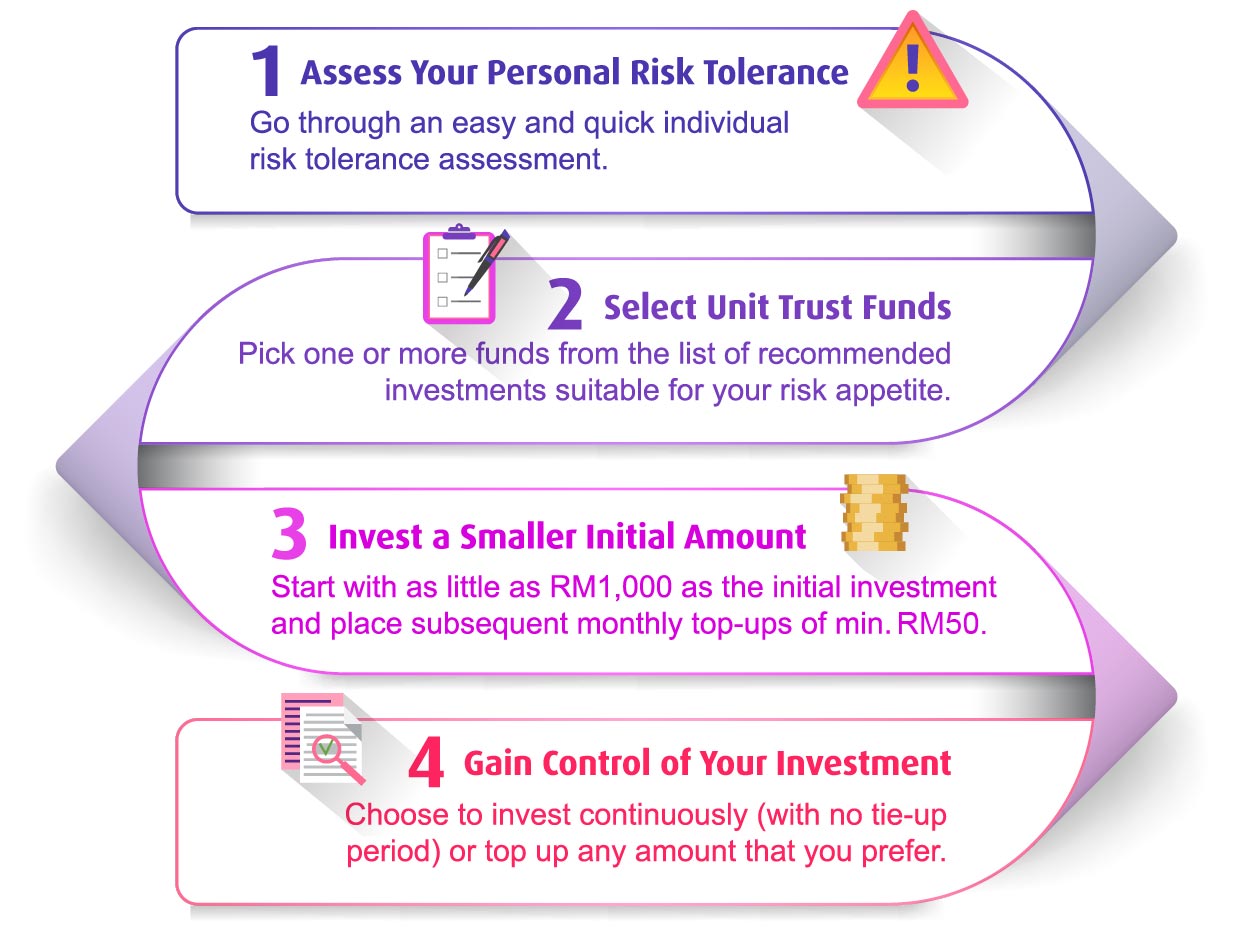

Start with as little as RM50 from a wide variety of Unit Trust Investments and

place subsequent monthly top-ups of the same amount or more.

Anything amiss? Don’t worry! You can

monitor your Unit Trust RSP Investment

via HLB Connect anytime, anywhere at

your convenience.

Disclaimer

• This document is not intended to be an invitation or offer for subscription of Unit Trusts nor does it amount to a solicitation by the bank for subscription of Unit Trusts by anyone.

• Investors are advised to read and understand the contents of the prospectus before investing. Investors should note that there are fees and charges involved in the purchase of Unit Trusts. Investors are advised to consider the fees and charges involved before investing and consult their licensed financial or other professional advisors, if in doubt about any feature or nature of the fund. Please note, the price of units and dividends payable, if any, may go up or down. Past performance of a fund is not an indicator of its future performance. The returns on Unit Trust investments are not guaranteed and Unit Trusts do not constitute bank deposits or obligations nor guaranteed by the bank and are subject to investment risks, including the possible loss of principal amount invested.

• Unit Trusts Schemes are not protected by Perbadanan Insurans Deposit Malaysia (PIDM).

• Any money withdrawn from an insured deposit for the purpose of purchasing any units in a unit trust scheme is no longer protected by PIDM.

• This advertisement has not been reviewed by the Securities Commission Malaysia (SC).