These may interest you

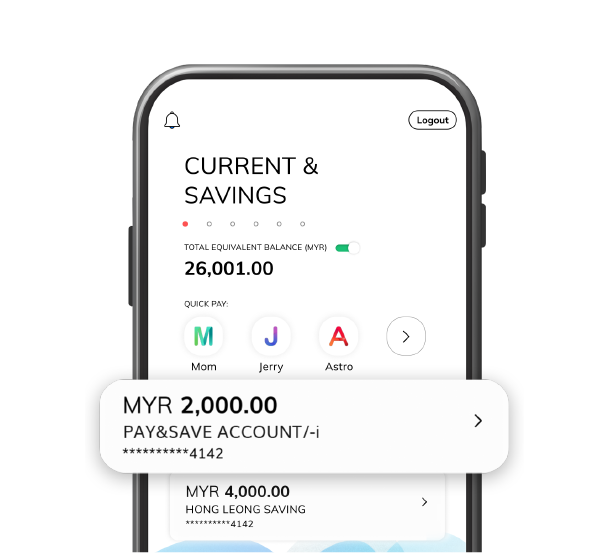

Pay&Save Account

with Multi-Currency Feature

Earn higher interest on your savings

Maximize the potential of your money. Earn up to 3.90% p.a. interest on your account balance when you make Pay&Save your everyday account.

SAVE

RM2,000 in one sum monthly

2.00% p.a.

Savings Interest

Savings Interest Rate

How it works

Interest Rate p.a.

Deposit RM2,000 (in one transaction) monthly for 3 consecutive months

2.00%

Interest is calculated daily and credit quarterly on the 1st of January, April, July and October.

Interest will be paid up to a maximum balance of RM100,000.

A minimum end-day balance of RM1,000 is required to be eligible.

PAY

RM500 online monthly

0.50% p.a.

e-Xtra Interest

e-Xtra Interest Rate

How it works

Interest Rate p.a.

Pay cumulative of RM500 bills online every month

(Including but not limited to JomPay billers; FPX registered merchants; HLB Credit Card/Loan repayments)

0.50% (RM30 maximum monthly)

Interest is calculated daily based on the each day’s end-day balance and credited on the 1st of the following month.

SPEND

RM500 with debit card monthly

0.50% p.a.

Bonus Interest

Bonus Interest Rate

How it works

Interest Rate p.a.

Spend cumulative of RM500 with you debit card every month

(Including but not limited to spend at petrol, shopping, groceries, dining, e-Wallet reload, etc)

0.50% (RM30 maximum monthly)

Interest is calculated daily based on the each day’s end-day balance and credited on the 1st of the following month.

INVEST

O.90% p.a.

Bonus Interest

Share Trading Bonus Interest Rate

How it works

Interest Rate p.a.

Min. 1 successful trade and up to RM20,000

0.30%

Up to RM30,000

0.50%

Up to RM100,000

0.70%

Above RM100,000

0.90%

Interest is calculated daily based on the each day’s end-day balance and credited on the 1st of the following month.

Note:*

For Purchase transactions:

MTA = [Unit x Purchase Price] + Transaction Costs

For Sell transactions:

MTA = [Unit x Selling Price] - Transaction Costs

Save

2.00%

p.a.Savings Interest

Savings Interest Rate

xHow it works

Interest Rate p.a.

Deposit RM2,000 (in one transaction) monthly for 3 consecutive months

2.00%

Interest is calculated daily and credit quarterly on the 1st of January, April, July and October.

Interest will be paid up to a maximum balance of RM100,000.

A minimum end-day balance of RM1,000 is required to be eligible.

Pay

0.50%

p.a.e-Xtra Interest

e-Xtra Interest Rate

xHow it works

Interest Rate p.a.

Pay cumulative of RM500 bills online every month

(Including but not limited to JomPay billers; FPX registered merchants; HLB Credit Card/Loan repayments)

0.50%

(RM30 maximum monthly)

Interest is calculated daily based on the each day’s end-day balance and credited on the 1st of the following month.

Spend

0.50%

p.a.Bonus Interest

Spend

0.50%

p.a.Bonus Interest

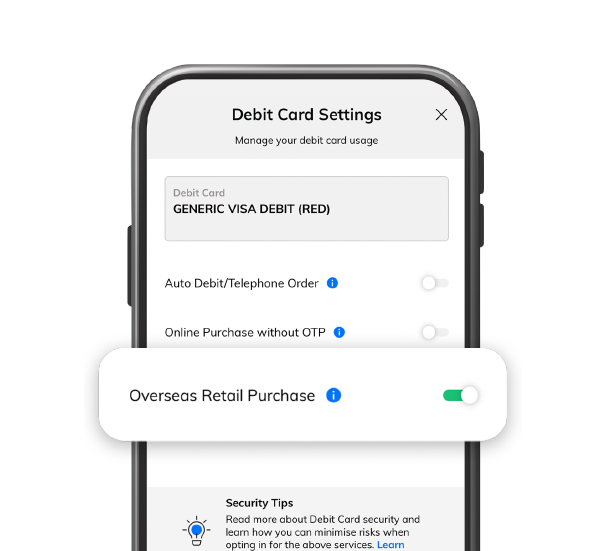

Spend cumulative of RM500 with your debit card every month

Learn More >Bonus Interest

xHow it works

Interest Rate p.a.

Spend cumulative of RM500 with you debit card every month

(Including but not limited to spend at petrol, shopping, groceries, dining, e-Wallet reload, etc)

0.50%

(RM30 maximum monthly)

Interest is calculated daily based on the each day’s end-day balance and credited on the 1st of the following month.

Invest

0.90%

p.a.Bonus Interest

Share Trading Bonus Interest Rate

xHow it works

Interest Rate p.a.

Min. 1 successful trade and up to RM20,000

0.30%

Up to RM30,000

0.50%

Up to RM100,000

0.70%

Above RM100,000

0.90%

Interest is calculated daily based on the each day’s end-day balance and credited on the 1st of the following month.

Note:* For Purchase transactions: MTA = [Unit x Purchase Price] + Transaction Costs

For Sell transactions: MTA = [Unit x Selling Price] - Transaction Costs

| Overview of Monthly Interest | Interest Rate | Amount |

|---|---|---|

| Savings Interest | 1.40% | RM116.67 |

| Bonus Interest | 1.40% | RM116.67 |

| e-Xtra Interest | 1.40% | RM116.67 |

| Share Trading Bonus Interest | % | RM |

| Total (per month) | 1.40% | RM116.67 |

The information shown is indicative and for illustration purpose only. Hong Leong Bank will not under any circumstances accept responsibility or liability for any losses that may arise from a decision that you may make as a result of using the calculator. Minimum account balance of RM10,000 is required in order to be eligible for Savings Interest. Savings Interest is calculated up to a maximum account balance of RM100,000, while e-Xtra Interest and Bonus Interest are capped at RM30 per month.

| Interest Rate p.a. (11/05/2023)

|

Mechanics

|

|

|---|---|---|

| Savings Interest Rate

|

1.25%

|

Deposit RM2,000 (lump sum) monthly for 3 consecutive month |

| e-Xtra Interest Rate

|

0.50% (RM30 maximum monthly) |

Pay cumulative of RM500 bills online every month |

| Bonus Interest Rate

|

0.50% (RM30 maximum monthly) |

Spend cumulative of RM500 with your debit card every month |

1

12

Enjoy multi-currency convenience with your Pay&Save Account.

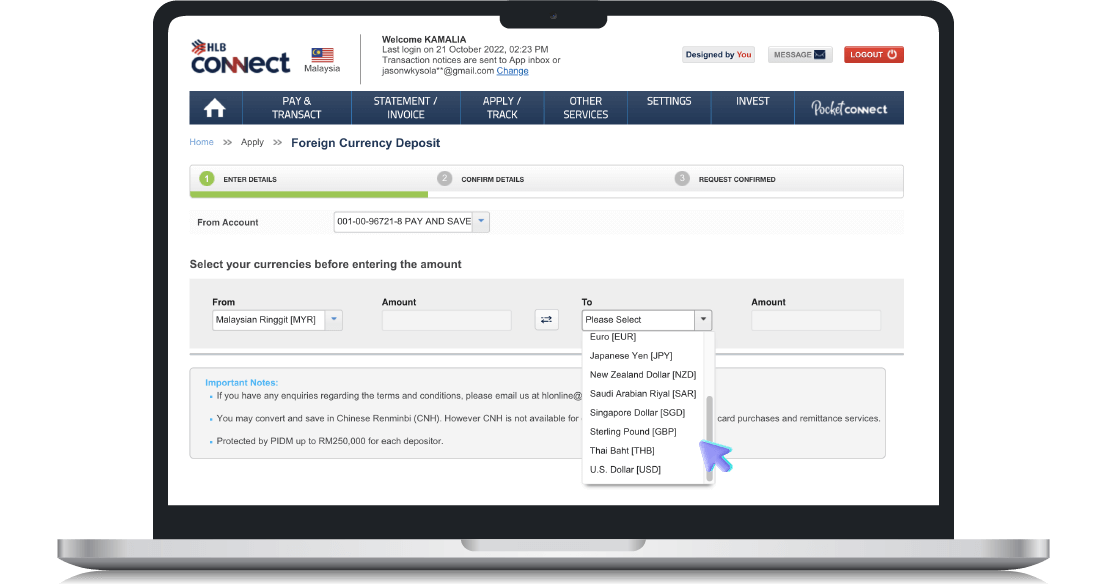

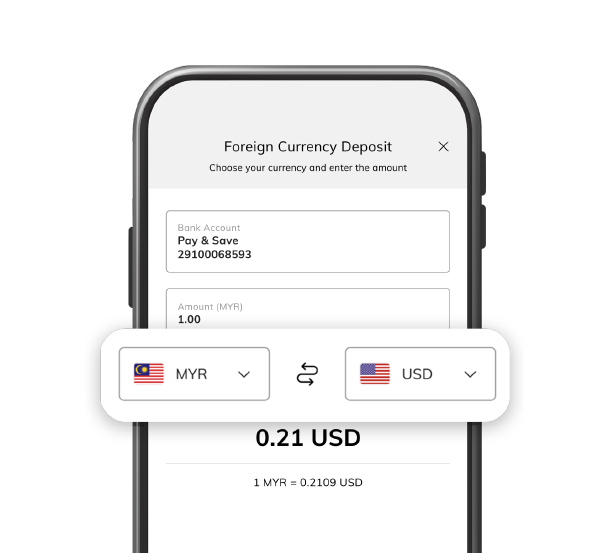

Whatever your needs may be, convert your MYR savings to foreign currencies with just a few clicks via HLB Connect at competitive FX rates.

Benefits of Pay&Save multi-currency feature:

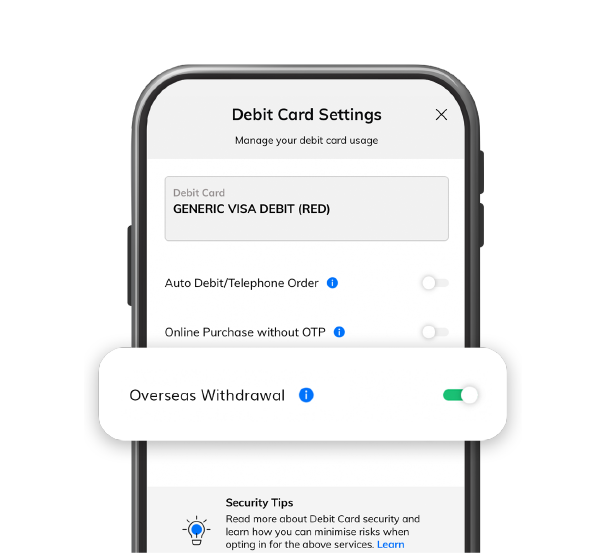

No need to exchange and carry cash when travelling overseas

Spend in foreign currency using your HLB Debit Card in over 31 countries

Withdraw foreign currency from ATMs overseas

Send and receive foreign currencies

Receive currency exchange rate alert

Travel with 12 major

foreign currencies

Convert and save your money in different currencies with competitive exchange rates in just a single wallet

Amount

Converted To

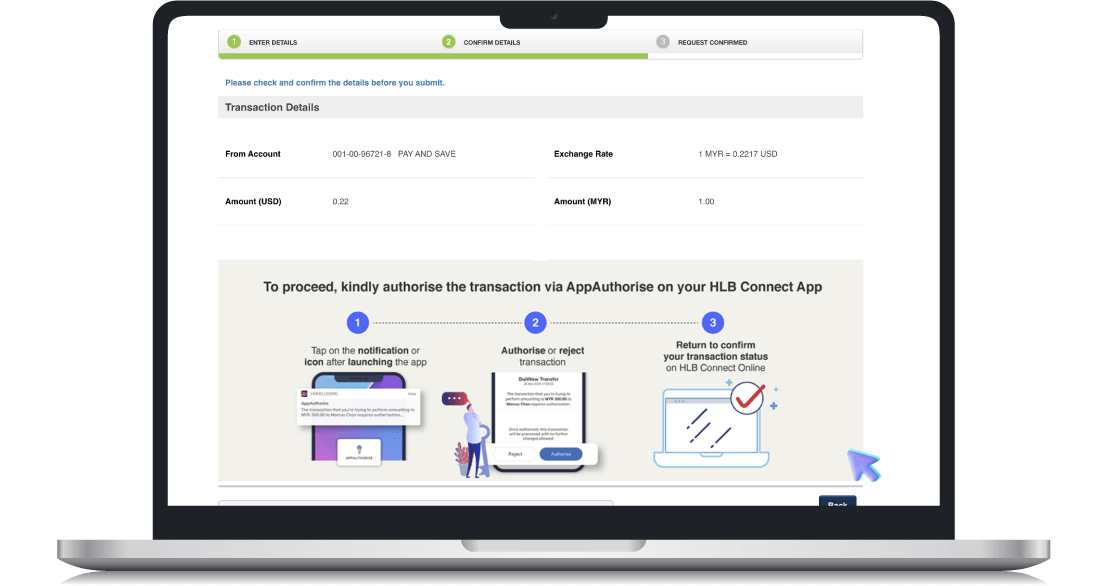

All rates are indicative and may vary due to market conditions.

Please login to HLB Connect for Foreign Currency Deposit and actual forex rates.

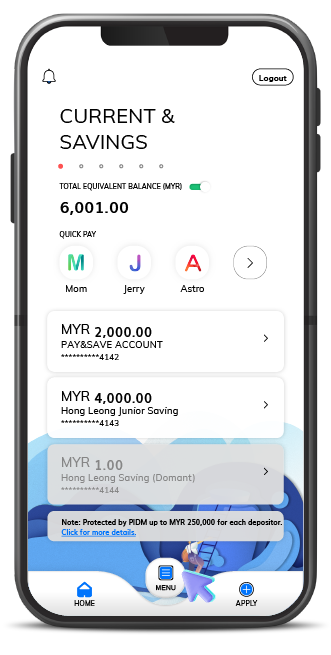

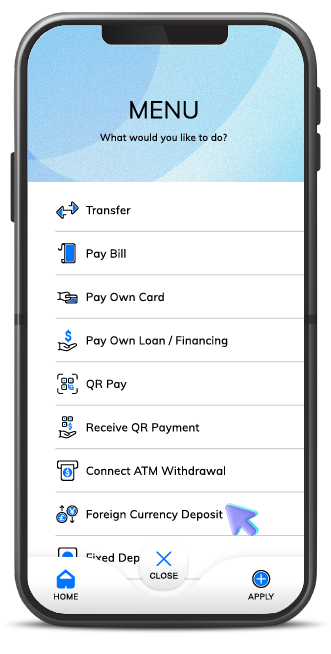

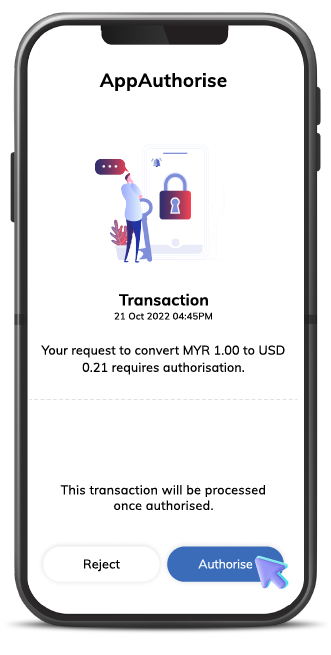

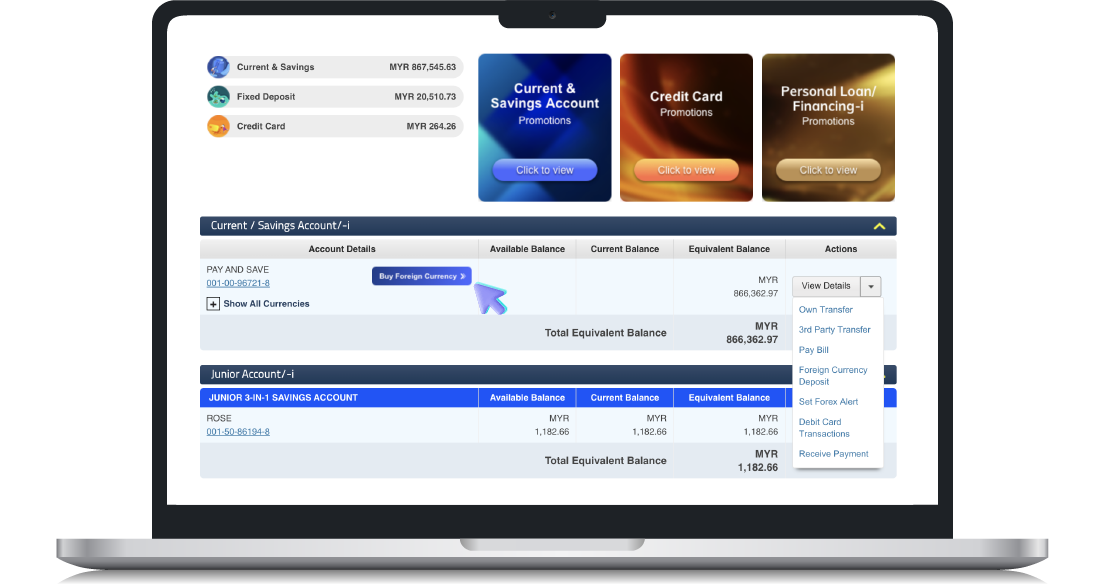

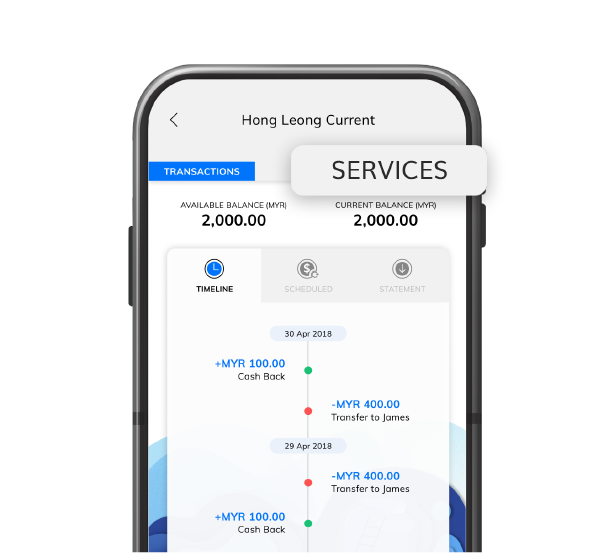

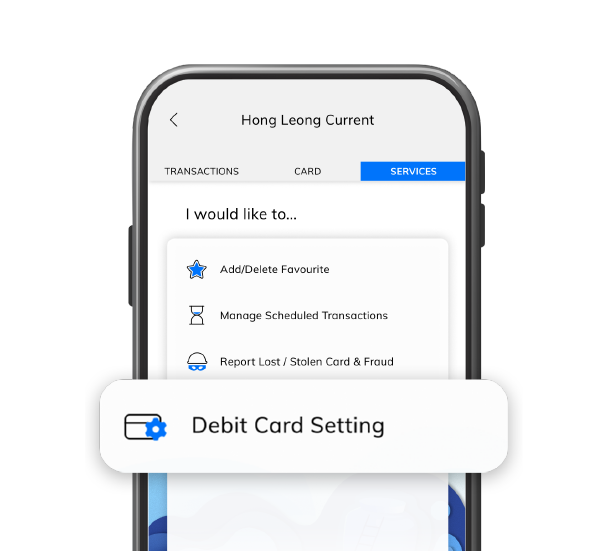

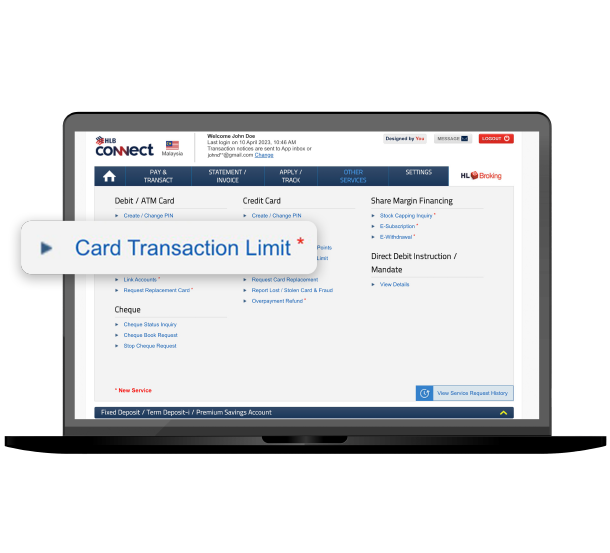

How to buy foreign currency with your Pay&Save Account

Click on each step to view app screen

Click on each step to view web screen

We offer door-to-door account opening service at selected locations

Make An Appointment >Visit our nearest branch

Locate Branch >We offer door-to-door account opening service at selected locations

Make An Appointment >Visit our nearest branch

Locate Branch >Eligibility

-

Malaysia residents and non-residents, 18 years old and above

-

For individuals, either on single or joint-name basis (Joint-name account holders are not eligible for multi-currency)

-

Minimum RM50 to open the account

KINDLY BE REMINDED:

The operations, sources and uses of funds to and from the MCF Enabled Account shall be governed in accordance with the Investment Foreign Currency Asset (“IFCA”) under the Foreign Exchange Policy Notices ("FEP Notices") issued by Bank Negara Malaysia (“BNM”).

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

Savings Interest Rate (wef 14/07/2025)

| Mechanism

|

Interest Rate p.a.

|

|---|---|

| Place RM2,000 single deposit for 3 consecutive months

|

2.00%

|

Interest is calculated daily and credited quarterly on the 1st of January, April, July and October.

Interest is calculated based on the account’s end-day balance, for up to RM100,000.

Debit Card Bonus Interest Rate

| Mechanism | Bonus Interest p.a.

|

|---|---|

| Spend RM500 cumulative monthly

|

0.50%

(RM30 maximum monthly) |

Interest is calculated monthly based on Monthly Average Balance and credited on the 1st of the following month.

e-Xtra Interest Rate

| Mechanism | Interest Rates p.a.

|

|---|---|

| Pay RM500 cumulative monthly

|

0.50%

(RM30 maximum monthly) |

Interest is calculated monthly based on Monthly Average Balance and credited on the 1st of the following month.

Share Trading Bonus Interest Rate

|

Total Monthly Traded Amount (MTA*) (RM) |

Bonus Interest Rates p.a. |

|---|---|

|

Min. 1 successful trade and up to RM20,000 |

0.30% |

|

Up to RM30,000 |

0.50% |

|

Up to RM100,000 |

0.70% |

|

Above RM100,000 |

0.90% |

Interest is calculated monthly based on Monthly Average Deposit Balance and credited on the 1st of the following month.

Note:* For Purchase transactions: MTA = [Unit x Purchase Price] + Transaction Costs

For Sell transactions: MTA = [Unit x Selling Price] - Transaction Costs

Important notice

Please click HERE for the exhaustive list of fees and charges.