You miss 100% of the shots you don’t take: When asked, many people

say they haven’t started investing yet. The most common reasons given are

that the market doesn’t look so good now, they don’t feel ready or that

their friends have told them to wait for a better time.

Here’s our take on this: ‘Later’ might be as good as never. While there’s

never a perfect time, there are ways to start your investment journey and

begin building a portfolio that can help meet your financial needs. Starting

early makes a huge difference on how much you can gain over your

investment journey. In this article, we break it all down for you.

Enjoy the magic

of compounding interest

In short, compounding interest is like a snowball rolling downhill that

keeps getting bigger and bigger. Compounding interest means earning

interest on your money, as well as earning interest on your interest.

It pays to invest early and often: there’s more time to accumulate

wealth, and your wealth also has more time to grow by itself, providing

bigger gains in the long run.

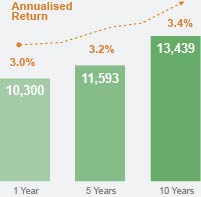

A simple illustration:

Invest RM10,000 with a 3% return

per annum (p.a.), one year later

you’ll have RM10,300 – a profit of

RM300. If you reinvest all of that

at the same 3% p.a., you will

have RM10,609 at the end of the

second year. Money makes

money, and every year, it will

keep doing more!

“Compound interest is the

eighth wonder of the world.

He who understands it,

earns it; he who doesn't, pays it.”

Albert Einstein

Mistakes won't

affect you as much

One of the biggest fears is losing money due to inexperience. However,

this is a chicken and egg problem, if you never start, you will never gain

experience or confidence.

It makes sense to start early, and start small. You may make mistakes

at first, but time is on your side. Generally, the earlier you start investing,

the more risks you can take as any losses have more time to recover. Once

you’re older, you have more commitments and therefore, less chances to

fail. We’ve written about ‘time in the market’, you can read it here.

It also helps that investing in unit trusts (a professionally managed

portfolio of various securities) and index funds (follows a market index

such as the US S&P500) are getting progressively easier to do. Just start

there and stay invested to enjoy the gains in the long run.

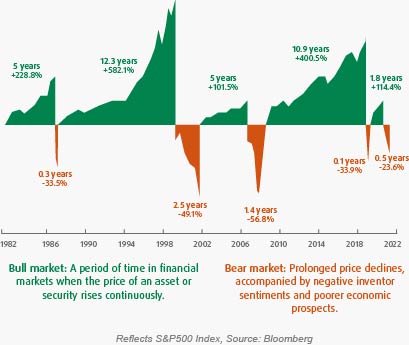

Remember, bull markets tend to last longer than bear markets.

Retire early,

do what you love

The dream of almost every

working adult: Retire young, have

time for yourself, loved ones and

hobbies. Around the world, this

dream has even become a

movement — just look up Financial

Independence, Retire Early (F.I.R.E.)

F.I.R.E. is a mindset of extreme saving and investment in order to retire

earlier. By living frugally and dedicating a huge portion of income to

investment, the aim is to be able to live off passive income or

accumulated savings.

The first two letters are the most important: (F)inancial (I)ndependence

— you don’t necessarily have to retire, but you can work on something you

love, rather than something you have to do to survive.

Let us help you

get started today:

No matter how young or how old you are, no matter how much capital

you may or may not have at the moment, it’s never too late. There are

plenty of online learning resources, or you can consult your bank for

financial advice.

At Hong Leong Bank, we’re always ready to help anyone become a

better investor and walk with you step by step as you embark upon your

investment journey. Visit your nearest priority banking centre or bank

branch. If you prefer, click here to start your journey online with HLB

Invest+

The information provided above is for reference and education purposes only. While all reasonable efforts have been made to ensure that the information provided is accurate

and up-to-date, the Bank does not warrant or guarantee the accuracy, completeness or timeliness of the information or data provided.

Neither the Bank nor its information providers shall be held responsible or liable for any errors, delays or inaccuracy of the price, data or

information provided herein nor for any loss or damage arising directly or indirectly from any action taken in reliance on the information provided herein.

Money withdrawn from your insured deposit(s) is no longer protected by PIDM if transferred to a non-deposit account. eg. Unit Trust,

Bond Dual Currency Investment (DCI), Negotiable Instrument of Deposit (NID) and Floating Rate Negotiable Instrument of Deposit (FRNID), Structured Investment,

ASNB, Investment Account-i etc.

This article is part of Hong Leong Bank’s educational series, called ‘Fresh Take’.

Here, we seek to present you a fresh, unbiased perspective of all matters financial.

We’ll be uploading more educational content moving forward, so do watch out for

the next piece.

In a world that’s awash with information that may be either true, false or

anywhere in between, Fresh Take aims to cut through the clutter, and help you on

your journey as an investor who’s seeking to build a strong financial future.

Please reach out if you need to know more,

or need personalised help.