Historically high levels of inflation are forcing the world’s central

banks to raise interest rates. Higher borrowing costs impacts

everyone, especially investors. As such, every release of

economic data (inflation, rate hikes, consumer price indices,

employment rates/wages, etc) drives negative reactions from

global markets – eg. instilling fear among investors and

weakening the exchange rates of some

traditionally strong currencies.

In this storm of uncertainty, what should investors do?

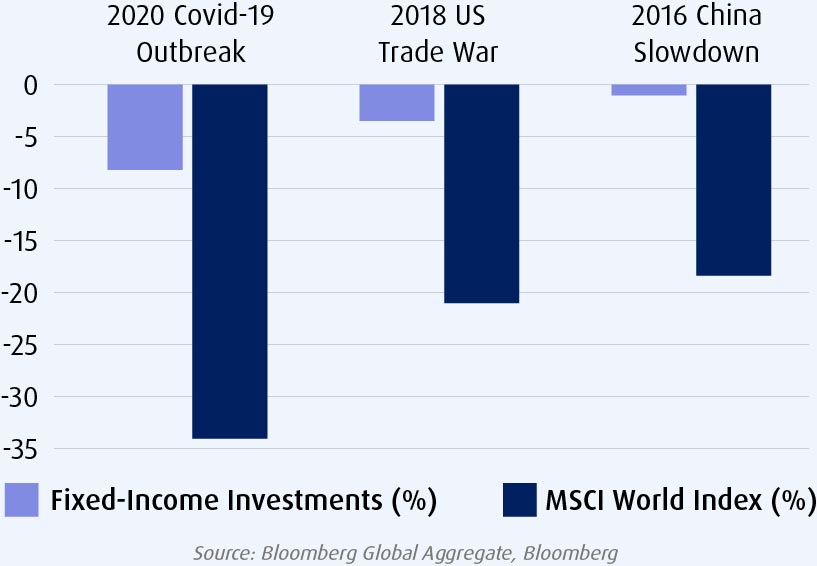

INCOME-CENTRIC INVESTMENTS HELP CUSHION MARKET SHOCKS

Low-risk assets such as fixed income investments fare better during

market shocks. This is because they continue to generate income

even in a volatile market as the chart below shows.

Understanding the chart:

A ‘drawdown’ is the difference between the highest and

lowest point of a decline during a specific period for an

investment, trading account, or fund - usually quoted as

a percentage. Drawdowns measure the historical risk of

different investments, comparing fund performance,

or monitoring personal trading performance.

Fixed-income investments can cushion

deep losses from market selloffs.

Maximum drawdowns during past crises

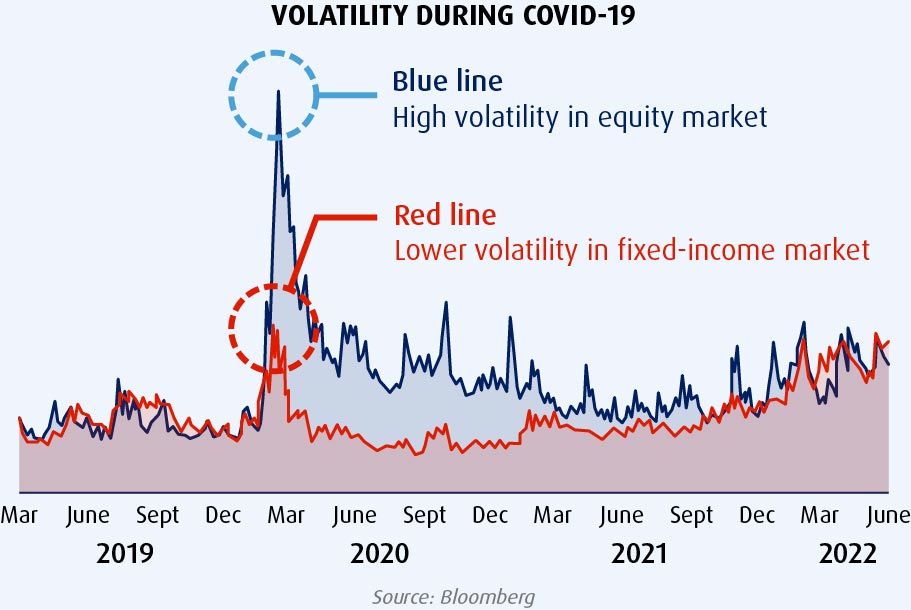

WILL YOU HAVE EXTRAORDINARY RETURNS OR EXTRAORDINARY LOSSES?

It’s natural to want to focus on maximising returns but do remember —

the risk can be very high. Recovering from possible losses may take

many years. Staying defensive by investing in a steady flow of income

to ride out market uncertainties may be a better way to go.

BOND FUNDS: THE MOST COMMON

FIXED-INCOME INVESTMENTS

When markets are uncertain, bond funds tend to provide the best

balance between risk and reward as they generate stable income in

a predictable manner. Income can be generated from various types

of bond investments that provide different levels of fixed returns,

regardless of how badly equity markets may perform, before the

funds declared income distribution to unit holders. If you, like many

other investors, feel that being defensive is a smart choice, contact

us and let us help.

Disclaimer

• Any money withdrawn from an insured deposit for the purpose of purchasing any units in a unit trust scheme, bond, FRNID, Structured Product are no longer protected by Perbadanan Insurans Deposit Malaysia (PIDM).

• Customers and/or through their professional advisers should assess various risks in respect of the product and consider related issues thereof which include but not limited to legal, tax, regulatory, financial and accounting issues prior to purchasing the product.

• The decision of purchasing the product shall be based solely on the Customer’s judgment and/or advice of their professional advisers.

• Customers are advised to read and understand the Term Sheet and Risk Disclosure Statement for detailed terms, conditions applicable and risks of investing in this product. • The returns on this product are uncertain and the customer risks earning no returns at all.

• Product Disclosure Sheets (“PHS”) are available at HLB branches and websites. PHS and any other product disclosure documents should be read and understood before making any investment decision.

• This advertisement has not been reviewed by the Securities Commission Malaysia (SC).