Personal Loan/Financing-i | 01 October 2025-31 December 2025

*Interest/profit rate of 2.87% p.a. is applicable for self-employed customers with a verified monthly income of RM8,000 who have their financing disbursed to their HLB/HLISB Current Account/Current Account-i and/or Savings Account/Savings Account-i (“HLB CASA/HLISB CASA-i”), and who are eligible for 65% Pay-On-Time Rebate on flat interest/profit rate of 8.20% p.a.

Our rate is on a flat rate basis

|

Verified Monthly Income |

Disbursement to non HLB CASA/HLISB CASA-i |

Disbursement to HLB CASA/HLISB CASA-i |

||||

|---|---|---|---|---|---|---|

|

Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate | Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate | |

|

RM2,000 – RM7,999 |

10.50% p.a. |

20% |

8.40% p.a. |

8.50% p.a. |

20% |

6.80% p.a. |

|

RM8,000 and above |

55% |

4.725% p.a. |

65% |

2.975% p.a. |

||

(i) Effective interest/profit rates applicable to flat rate of 10.50% p.a. vary from 19.61% p.a. to 20.76% p.a. depending on loan/financing tenures from 2 to 5 years.

(ii) Effective interest/profit rates applicable to flat rate of 8.50% p.a. vary from 15.99% p.a. to 16.71% p.a. depending on loan/financing tenures from 2 to 5 years.

(iii) 0.50% of the Facility Amount will be deducted upon disbursement for stamp duty payable.

(iv) To enjoy the Pay-On-Time Rebate, please ensure to:

a. Pay your monthly instalment promptly by the due date.

b. Maintain a cumulative daily balance of RM500 in your HLB CASA/HLISB CASA-i (only applicable for loan/financing-i disbursements to HLB CASA/HLISB CASA-i)

Our rate is on a flat rate basis

|

Verified Monthly Income |

Disbursement to non HLB CASA/HLISB CASA-i |

Disbursement to HLB CASA/HLISB CASA-i |

||||

|---|---|---|---|---|---|---|

|

Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate | Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate | |

|

RM2,000 – RM7,999 |

10.50% p.a. |

20% |

8.40% p.a. |

8.20% p.a. |

20% |

6.80% p.a. |

|

RM8,000 and above |

55% | 4.725% p.a. |

65% |

2.87% p.a. | ||

(i) Effective interest/profit rates applicable to flat rate of 10.50% p.a. vary from 19.61% p.a. to 20.76% p.a. depending on loan/financing tenures from 2 to 5 years.

(ii) Effective interest/profit rates applicable to flat rate of 8.20% p.a. vary from 15.44% p.a. to 16.11% p.a. depending on loan/financing tenures from 2 to 5 years.

(iii) 0.50% of the Facility Amount will be deducted upon disbursement for stamp duty payable.

(iv) To enjoy the Pay-On-Time Rebate, please ensure to:

a. Pay your monthly instalment promptly by the due date.

b. Maintain a cumulative daily balance of RM500 in your HLB CASA/HLISB CASA-i.

Our rate is on a flat rate basis

|

Verified Monthly Income |

Disbursement to HLB CASA/HLISB CASA-i |

||

|---|---|---|---|

|

Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate | |

|

RM2,000 – RM7,999 |

8.00% p.a. |

20% |

6.40% p.a. |

|

RM8,000 and above |

65% | 2.80% p.a. | |

(i) Effective interest/profit rates applicable to flat rate of 8.00% p.a. vary from 15.08% p.a. to 15.71% p.a. depending on loan/financing tenures from 2 to 5 years.

(ii) 0.50% of the Facility Amount will be deducted upon disbursement for stamp duty payable.

(iii) For HLB/HLISB customers with an active Personal Loan/Financing-i for more than twelve (12) months; and/or

(iv) For customers with active Personal Loan/Financing-i with other banks.

(v) To enjoy the Pay-On-Time Rebate, please ensure to:

a. Pay your monthly instalment promptly by the due date.

b. Maintain a cumulative daily balance of RM500 in your HLB CASA/HLISB CASA-i.

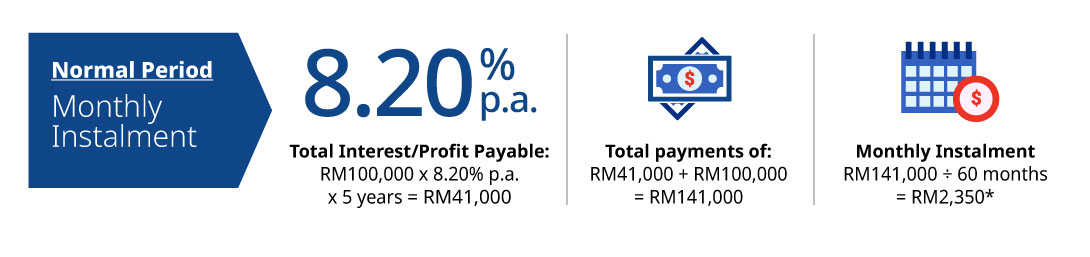

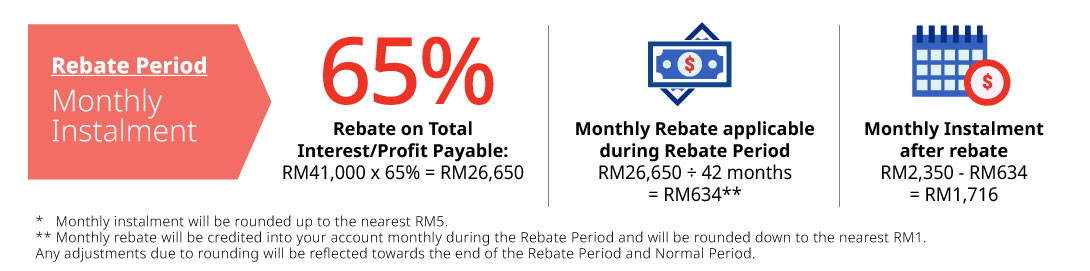

Enjoy up to 65% interest/profit rebate when you pay on time!

For example, you are a self-employed customer with a verified monthly income of RM8,000 and above that disbursement is to HLB CASA/HLISB CASA-i. The applicable interest/profit rate is 8.20% p.a. and your total approved facility amount is RM100,000 for a financing tenure of 5 years. You also qualify for 65% Pay-On-Time Rebate. The above example is illustrated below:

- Malaysian citizens aged between 21 to 60 years old

- Employed or self-employed with a minimum annual income of RM24,000

- Minimum loan/financing amount is RM5,000

- Maximum loan amount is RM250,000 for Personal Loan and maximum financing amount is RM150,000 for Personal Financing-i

- Facility tenures from 2 to 5 years

Visit HLB/HLISB nearest branch today.

Terms and conditions apply.