Personal Loan/Financing-i | 16 June 2025-30 June 2025

Our rate is on a flat rate basis

Application Channel: HLB Connect Online |

||

|---|---|---|

Verified Monthly Income |

Flat Interest/Profit Rate |

Facility Tenure |

RM2,000 - RM4,999 |

5.00% p.a. |

2 to 5 years |

| RM5,000 and above | 3.99% p.a. | |

Note: The effective interest/profit rates vary as follows for loan/financing-i tenure from 2 to 5 years:

(i) Flat interest/profit rate 3.99% p.a.: Effective interest/profit rates vary from 7.40% p.a. to 7.49% p.a.

(ii) Flat interest/profit rate 5.00% p.a.: Effective interest/profit rates vary from 9.15% p.a. to 9.32% p.a.

Illustration of Instalments

For example, you are an applicant with a verified monthly income of RM5,000 and above and you apply via the Bank’s Website. The applicable interest/profit rate is 3.99% p.a. and your total approved facility amount is RM80,000 for a financing tenure of 5 years. The above example is illustrated below:

*Monthly instalment amount will be rounded up to the nearest RM5.

Any adjustment due to rounding will be reflected towards the end of the facility tenure.

- Malaysian citizens aged between 21 to 60 years old

Employed (i.e. salaried workers) with minimum annual income of RM24,000

Minimum loan/financing amount is RM5,000

Maximum loan amount is RM250,000 for Personal Loan and maximum financing amount for Personal Financing-i is RM150,000.

Exclusively for applications via HLB Connect Online only

Applicant must hold at least one (1) valid and active individual Hong Leong Bank Current/Savings Account or Hong Leong Islamic Bank Current/Savings Account (joint and corporate accounts are not eligible)

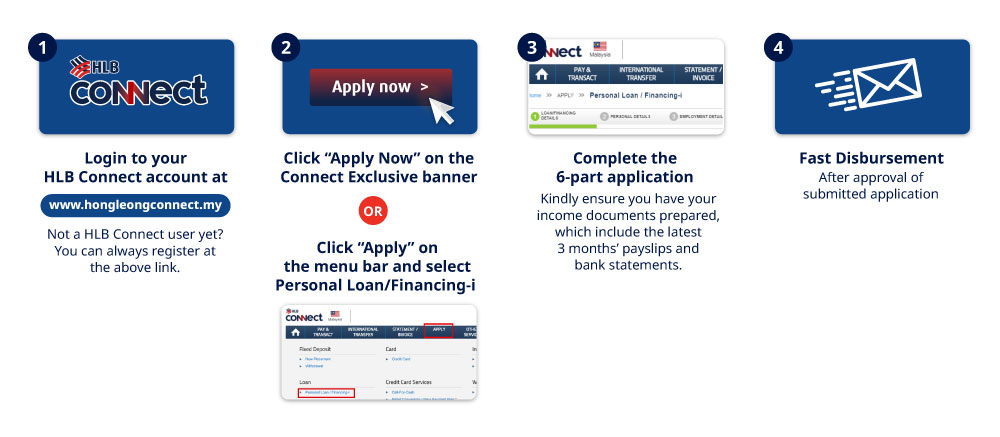

Click here to login and apply. Then, follow the steps below: