Personal Loan/Financing-i | 13 October 2025-31 December 2025

Need money for your business or personal goals?

Get it with rates as low as 2.87% p.a. when you pay on time.

Our Personal Loan Offer helps you get the funds you need while rewarding you when you pay on time. Whether you are running a small business or are a salaried employee, use this money to grow, take new chances, and achieve your biggest dreams.

Who Can Apply?

If you are a Malaysian citizen and have an active Hong Leong Bank (HLB) or Hong Leong Islamic Bank (HLISB) account:

Age

21 to 60 years old

Income

RM2,000/month

(or RM24,000/year)

This includes money you get from your job or from your own business

Bank Account

You need an active

HLB/HLISB Current or Savings Account

For us to disburse the funds

No Overdue Payments

You must not have any

late/missing payments

On your current HLB Personal Loan or HLISB Personal Financing-i

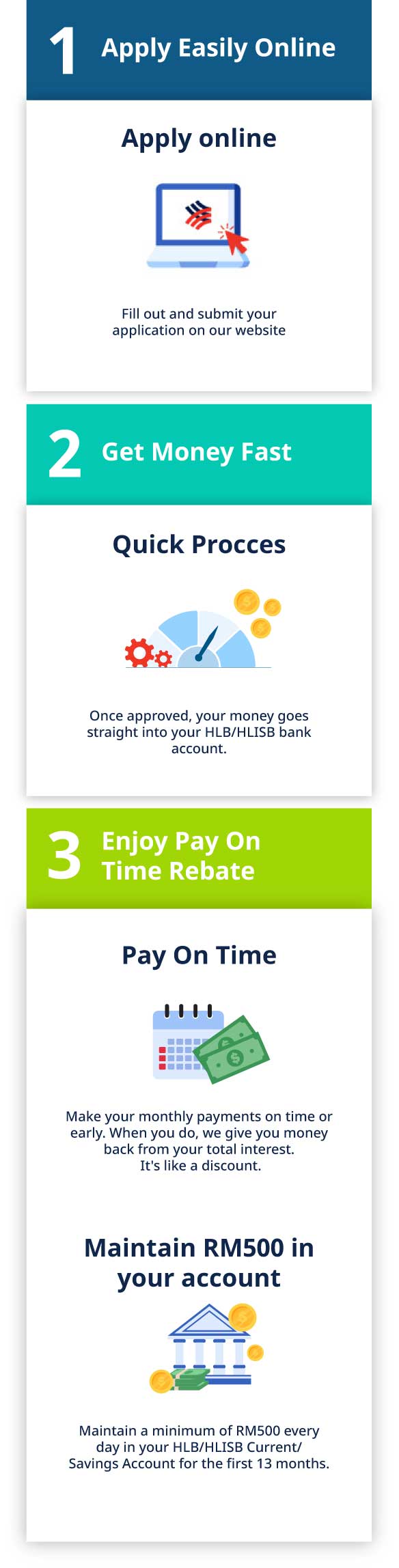

How to save money by paying on time.

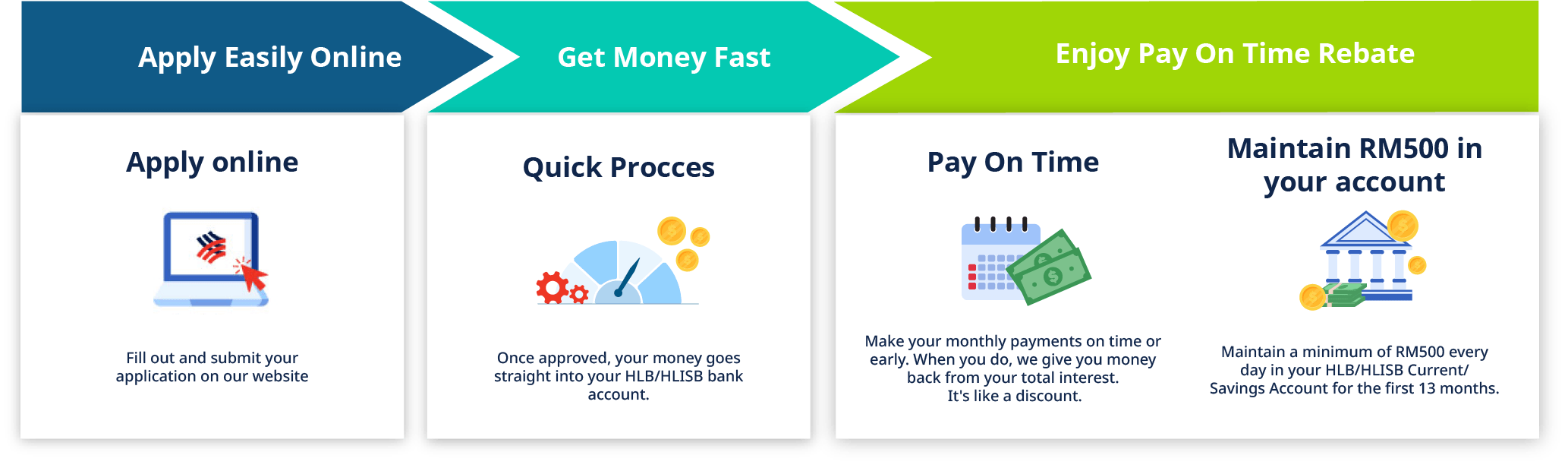

We offer competitive rates from the start, and we want to reward you when you pay your monthly instalments on time. Our Pay-On-Time Rebate puts money back into your pocket. This helps your finances, whether for personal use or your business.

Your Rebate, Explained Simply

Just be sure to make your monthly instalments on time every month. Your pay on time rebate will be credited in your loan account starting from your 14th payment and continues until six months before your final payment. This means you will have lower monthly instalments for most of your financing tenure. This helps you save cash for what matters.

See Your Interest Savings in Action (Save up to RM26,650)

Let's compare two business owners, Hanna and Jackie, who each borrow RM100,000 over 5 years (60 months). Both earn an income of RM8,000 and is self-employed.