Cards | 01 October 2024-12 February 2025

Looking to consolidate your other oustanding card balance, or get extra cash from your HLB Credit Card?

No documents required, apply via HLB Connect today for instant approval in just a few simple steps!

Balance Transfer

|

Tenure |

Minimum Amount |

Maximum Amount |

Balance Transfer with Monthly Interest |

|---|---|---|---|

|

3 months |

RM1,000 |

90% of the Eligible Cardholders’ existing available credit limit, subject to HLB’s approval |

0.88% |

|

6 months |

RM1,000 |

1.88% |

|

|

12 months |

RM1,000 |

2.88% |

|

Tenure |

Minimum Amount |

Maximum Amount |

Balance Transfer with Monthly Interest |

|---|---|---|---|

|

Lifetime |

RM1,000 |

90% of the Eligible Cardholders’ existing available credit limit, subject to HLB’s approval |

5.28% p.a. |

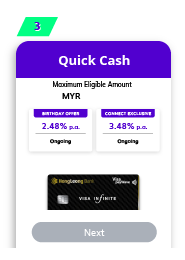

Quick Cash

|

Tenure |

Minimum Amount |

Maximum Amount |

Quick Cash with One-Time Fee |

|---|---|---|---|

|

3 months |

RM500 |

90% of the Eligible Cardholders’ existing available credit limit, subject to HLB’s approval |

0.88% |

|

6 months |

RM500 |

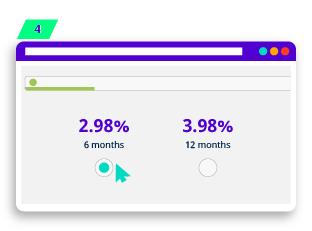

1.88% |

|

|

12 months |

RM500 |

2.88% |

Here’s How

Instantly ease your financial burden with just a few simple clicks on HLB Connect.

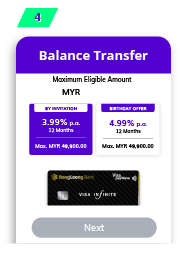

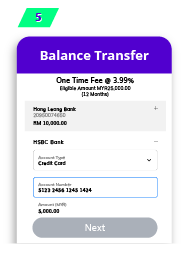

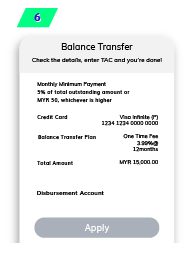

How to apply for Balance Transfer

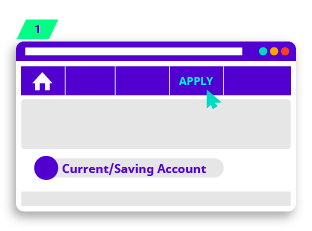

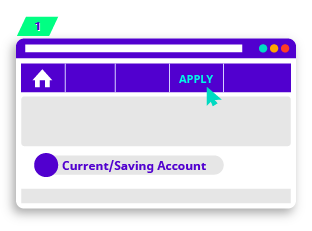

HLB Connect Online

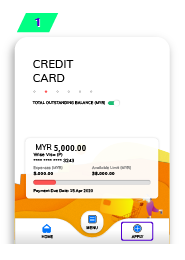

Login to your HLB Connect Online Banking and click “Apply”

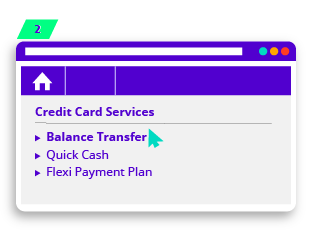

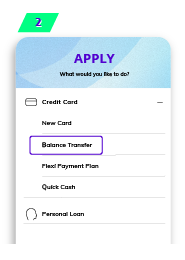

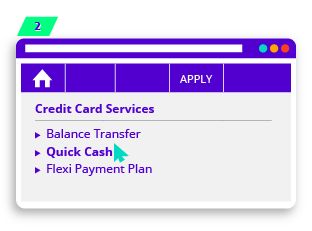

Under “Credit Card Services” select “Balance Transfer”

Select your preferred credit card and plan

Select your preferred interest rate

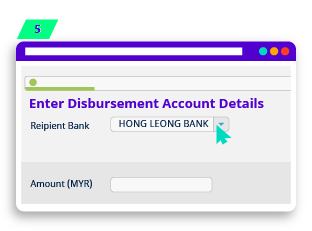

Enter disbursement account details

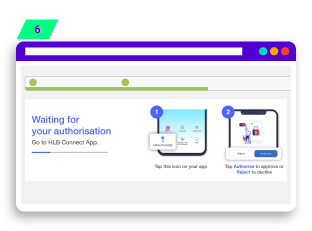

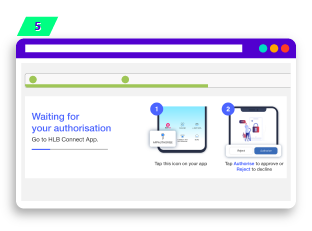

Authorise the application through HLB Connect App

Login to your HLB Connect App, and tap “Apply”

Select “Balance Transfer”

Select your preferred credit card and plan

Select your preferred interest rate

Enter Credit Card details

Confirm details and enter TAC

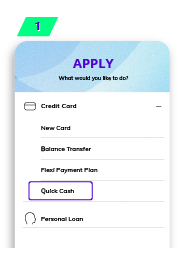

How to apply for Quick Cash

HLB Connect Online

Login to your HLB Connect Online Banking and click “Apply”

Under “Credit Card Services” select “Quick Cash”

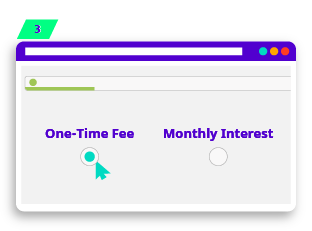

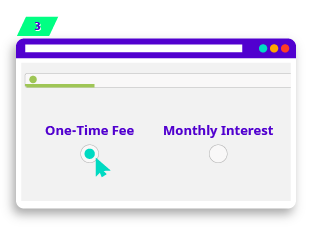

Select One-Time fee/Monthly interest option and plan

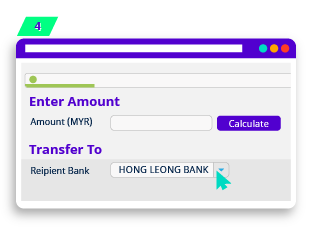

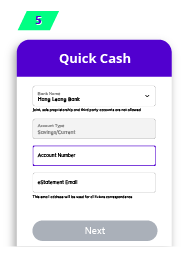

Enter amount, select tenure and bank account details

Authorise the application through HLB Connect App

Login to your HLB Connect App, tap “Apply” and select “Quick Cash”

Choose your preferred credit card and Quick Cash plan

Select your preferred interest rate

Enter amount and select your monthly instalment amount and tenure

Select bank and enter your bank account details

Confirm details, enter TAC and tap “Apply”

- Balance Transfer Terms & Conditions (One-Time-Fee Seasonal Special)

- Balance Transfer Product Disclosure Sheet (One-Time-Fee Seasonal Special)

- Balance Transfer Terms & Conditions (Lifetime Seasonal Special)

- Balance Transfer Product Disclosure Sheet (Lifetime Seasonal Special)

- Quick Cash Terms & Conditions (One-Time-Fee Seasonal Special)

- Quick Cash Product Disclosure Sheet (One-Time-Fee Seasonal Special)

![[By Invitation Only]: Exclusive 0% Interest Quick Cash Plan For You](/content/dam/hlb/my/images/campaigns/2024/cards-exclusive-balance-transfer-quick-cash-promotions/ps-a3-a4-a8-header-banner.jpg)