Why start now?

Future-Proof their education and financial well-being

With education costs on the rise, start a consistent savings plan now to pave the way for their dreams and build a strong foundation for their financial future.

With education costs on the rise, start a consistent savings plan now to pave the way for their dreams and build a strong foundation for their financial future.

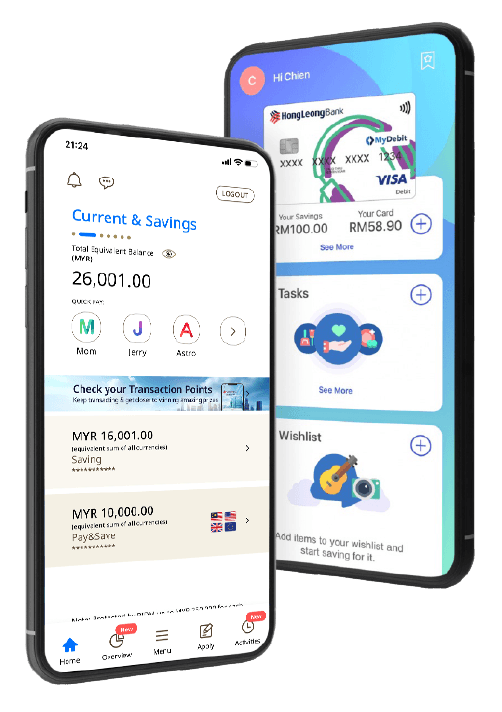

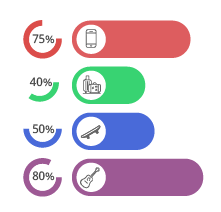

The HLB Pocket Connect App is Malaysia’s 1st Pocket Money App designed to help your child to learn how to EARN, SPEND and SAVE responsibly.

Your child can track their card balance, spending online and learn good money habits. Monitor your child’s pocket money balance and spending on HLB Connect App instantly.

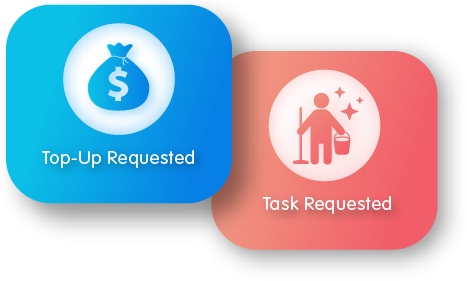

We’re here to help you teach your child the value of money. Let your child earn extra pocket money when they help with housework while you enjoy a little me-time. You can also reward them for doing well on that math exam. A win-win situation!

Cashless is the new norm, and your child is safer with a reloadable debit card than cash. With the Pocket Connect App, your child will be able to keep track of their pocket money and spending, while having the freedom to go cashless with their very own HLB Junior Debit Card.

The wishlist feature will be every parent’s new best friend. It will help your child save gradually towards their goal, whether it’s a pair of sneakers or the latest game.

We believe our children deserve a greener, more sustainable future. That’s why we’ve launched the EARTH HERO project, where children can earn one virtual tree for every task completed. Grow 20 virtual trees on the Pocket Connect App and we’ll plant an actual tree on your behalf.

| Balance Range |

Interest Rates p.a. |

|---|---|

| First RM50,000 |

2.15% |

| Above RM50,000 |

0.00% |

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

Important notice

Please click HERE for the exhaustive list of fees and charges.

Visit any Hong Leong Bank branches and bring along:

These may interest you