How to be future ready: Invest sustainably.

ESG Series, Part 2. Growth trajectory and unlimited potential of investing into ESG.

No Result

We have found 0 items that match what you searched for.

Earn income-like returns with the opportunity to invest in reputable companies at a discount to their current prices via ACEL

Earn income-like returns with the opportunity to invest in reputable companies at a discount to their current prices via ACEL

ACEL (Auto Callable Equity Linked Structured Investment) is an equity based investment that

pays an enhanced yield as compared to traditional deposits. The tenure can be as short as 1 month to

as long as 1 year. Depending on the price movement of the stock, investors may face the risk of having

to own the underlying upon maturity of the product.

However, the stock is purchased at a price which is lower than the initial market price, which is

the intention of certain investors. After all, it doesn’t harm to own a good quality stock in

your portfolio - you earn an enhanced yield while buying it cheaper.

What are the benefits of investing in ACEL?

Fixed Periodic Interest Payout

You can get regular

interest payments during the

investment period.

Stock Ownership

You can own a high quality

name at a cheaper price

while earning attractive yields.

Shorter Investment Horizon

You can decide on your

preferred investment period,

ranging from 1 to 12 months.

MYR 50,000.00

USD 10

ABC

USD 11

6 Months

USD 8

10.00% p.a.

4.25 (USD/MYR)

The minimum investment amount to invest in ACEL is RM50,000.

For a full list of risks of investing in ACEL, it is recommended to consult a licensed financial or professional advisor and refer to the documents in relation to the ACEL as different tranches may carry different risks to reflect the underlying asset.

In general, the risk in ACEL investment include the following to a certain degree:

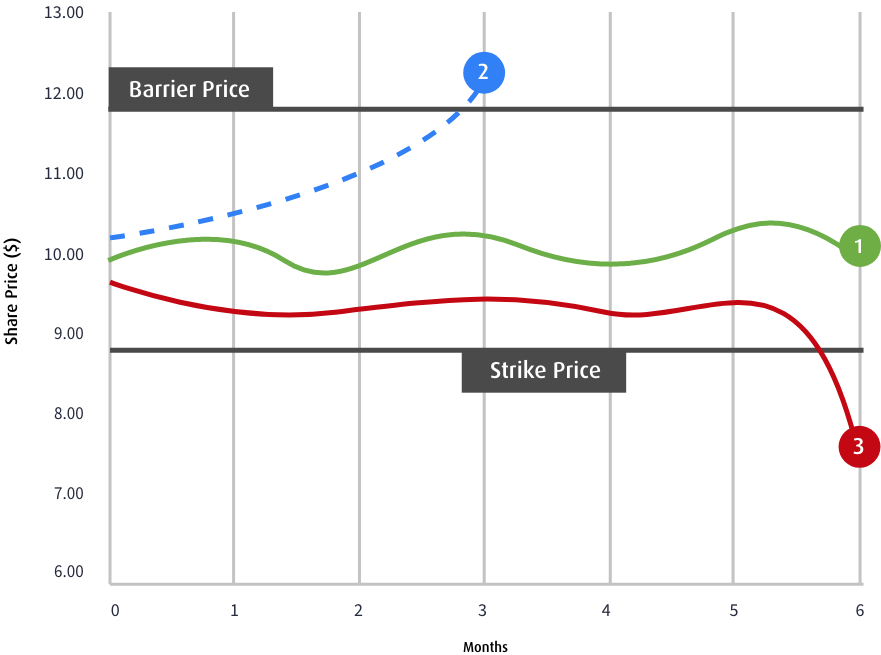

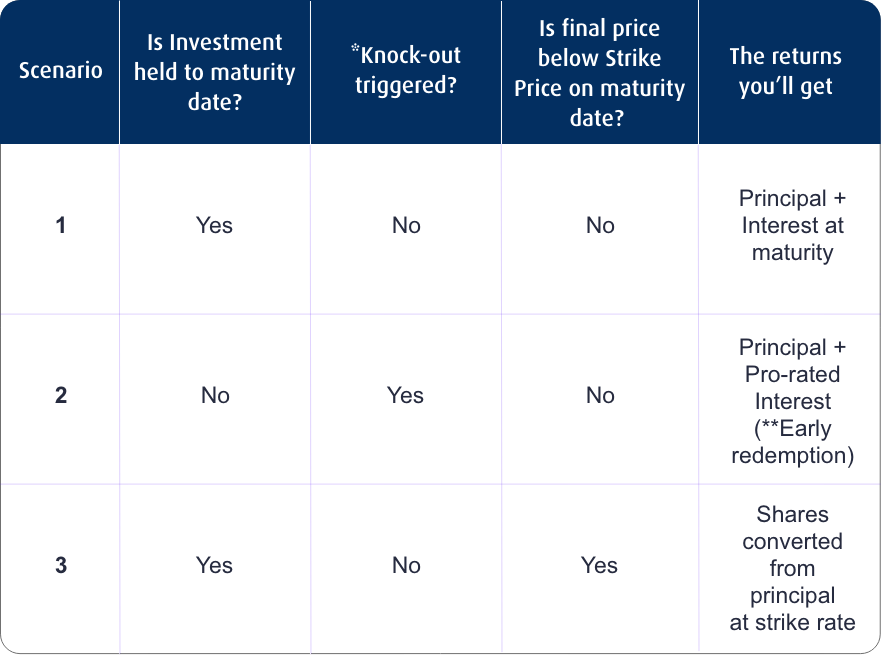

In the most simplified terms, the possible outcomes is summarised below:

All expenses relating to the delivery of the Underlying Financial Instrument, including but not limited to stock exchange levy, stamp duty, stock deposit, fee, custody fee and settlement fees imposed by the relevant brokerage house or custodian of the Underlying Financial Instrument, are payable by the customer.

Early Withdrawal Costs may be incurred if you withdraw before the maturity date. In such cases, you may not receive your full initial investment amount as the costs may be higher than your returns.

Warning:

The returns on structured product investment will be affected by the performance of the underlying asset/reference, and the recovery of your principal may be jeopardised if you make an early redemption. This structured product investment is not protected by Perbadanan Insurans Deposit Malaysia (PIDM).

Money withdrawn from your insured deposit(s) is no longer protected by PIDM if transferred to a non-deposit amount, e.g. Unit Trust, Bond, Dual Currency Investment (DCI), Negotiable Instrument of Deposit (NID) and Floating Rate Negotiable Instrument of Deposit (FRNID), Structured Investment, ASNB, Investment Account-i etc.

This advertisement has not been reviewed by the Securities Commission Malaysia (SC).

Learn, invest and grow with

Fresh Take

Here is some information to help you get started.

Choice of Approved Underlying Stock Names

Tap on our in-house quantitative screen methodology for a list of approved underlying stock names for ACEL that covers various sectors and regions.

Contact your Relationship Manager to find out more about ACEL.

Consider the

My personal or joint net assets with my spouse, excluding primary residence, exceeds RM3 million or its foreign currency equivalent; OR

My spouse and I have a joint gross annual income exceeding RM400,000 or its foreign currency equivalent; in the last twelve months; OR

My gross annual income exceeding RM300,000 or its foreign currency equivalent; in the last twelve months; OR

I or my spouse and I, have a personal or joint investment portfolio exceeding exceeding RM1 million or its foreign currency equivalent; in capital market products;

A trust company registered under the Trust Companies Act 1949 and manages asset exceeding RM10 million or its foreign currency equivalent; OR

A corporation with total net assets exceeding RM10 million or its foreign currency equivalent based on the last audited accounts; OR

A corporation engaged in fund management for its related companies and managing assets exceeding RM10 million or its foreign currency equivalent, falls under regulation; OR

A pension fund approved by the Director General of Inland Revenue under the income Tax Act 1967; OR

A public listed corporation under the Companies Act 2016, approved by the Securities Commission Malaysia, to act as a trustee under the CMSA and managing assets exceeding RM10 million or its foreign currency equivalent; OR

A partnership with total net assets exceeding RM10 million or its foreign currency equivalent; OR

A statutory body established under any laws, unless specified otherwise by the Securities Commission Malaysia.

For a full list of risks of investing in ACEL, it is recommended to consult a licensed financial or professional advisor and refer to the documents in relation to the ACEL as different tranches may carry different risks to reflect the underlying asset.

In general, the risk in ACEL investment include the following to a certain degree:

In the most simplified terms, the possible outcomes is summarised below:

All expenses relating to the delivery of the Underlying Financial Instrument, including but not limited to stock exchange levy, stamp duty, stock deposit, fee, custody fee and settlement fees imposed by the relevant brokerage house or custodian of the Underlying Financial Instrument, are payable by the customer.

Warning:

The returns on structured product investment will be affected by the performance of the underlying asset/reference, and the recovery of your principal may be jeopardised if you make an early redemption. This structured product investment is not protected by Perbadanan Insurans Deposit Malaysia (PIDM).

Money withdrawn from your insured deposit(s) is no longer protected by PIDM if transferred to a non-deposit amount, e.g. Unit Trust, Bond, Dual Currency Investment (DCI), Negotiable Instrument of Deposit (NID) and Floating Rate Negotiable Instrument of Deposit (FRNID), Structured Investment, ASNB, Investment Account-i etc.

This advertisement has not been reviewed by the Securities Commission Malaysia (SC).

External Link Disclaimer

You are leaving Hong Leong Bank's website as such our Privacy Notice shall cease. We wish to remind you on our terms on the use of links, Disclaimer and Reservation of Intellectual Property Rights.