“The past generation built great wealth. But they may have broken the planet while doing it.”

“The past generation built great wealth. But they may have broken the planet while doing it.”

Aerial view of a grain field that was devastated after

Aerial view of a grain field that was devastated after

a storm and heavy rain.

Business used to be simple. Build a great product, drive demand for it and manage costs well. Every year, shareholders would expect profit growth, dividends and share price growth. Good companies would deliver predictably, and their stock prices would reach lofty valuations.

But those expectations are getting harder and harder to meet, even as the tech sector has shown fascinating (although somewhat unpredictable) growth in the last two decades. While the recent pandemic was a giant boost to valuations, many predictions see prices hitting a ‘glass ceiling’ sooner or later.

What is this ‘glass ceiling’? Some think it has all to do with the dovish central bank bond issuances, unprecedented printing of money and negative interest rates. It’s true, but there’s one larger factor that looms over all of that.

The ultimate limiter is this planet we live on; its resources are finite. And thus we are seeing the results of the limits being breached.

Over at least a decade, countless scientists, civil society leaders and even astute businesses have warned that global warming and climate change are the two biggest challenges of our time. For 30 years now, the UN's COP has held annual meetings, and the growing group of global participants are signatories to a number of agreements. Progress, however, is still slow, and the planet continues to heat up at over the 2 degrees Celsius limit agreed to at COP21, otherwise known as the Paris Agreements of COP21 in 2015.

It’s not just the planet, its people and systems are also somewhat broken.

It’s not just the planet, its people and systems are also somewhat broken.

If we do not help the future generations now, who will be driving the gains in productivity that we depend on for our returns?

The UN Sustainable Development Goals are a globally agreed upon outline of a number of issues that need to be tackled urgently. These are some of humanity's most pressing problems.

What's more telling is that the range of issues is an indication of how much work is required to fix these issues around the world. Surely astute investors would already be projecting where outsized gains can be found by targeting companies who can deliver what is needed. Rather than argue this from the perspective of the ‘haves and have nots’, here’s an angle all business minded investors can agree on:

“By ignoring these issues, we are shortchanging ourselves on the available diversity of this planet and the productive gains that are possible now and well into the future if we could bring it all together.”

Can big business now fix the planet?

Can big business now fix the planet?

Time and again, governments around the world have shown that it is never the most efficient or equitable allocator of resources. Added regulations have the tendency to distort free market forces and push problems into the future.

There are many business leaders who are aware of the power for good that they wield. As such, they seek to capture the imaginations and trust of investors to ensure their continued access to capital as they invest in the paths that will lead us out of this mess.

It is the hope of many that other laggards will also begin to step up to the ESG plate and hit those home runs that will change how corporations are viewed and valued in the future.

Clearly, astute business leadership that demonstrates care for people and the planet know where their future growth and profits will come from.

The private sector and businesses tend to be more efficient simply because economic forces and survival dictate that they need to do so.

ESG investing forces their hand in directing their efforts towards areas of the economy that will be good for all.

The solution is in ESG;

The solution is in ESG;

unfortunately, it’s hard to do.

But do it they must or suffer their fate; where they will find it harder and harder to access capital through public markets or worse, find their valuations slashed to the bone.

There are many resources from which a basic understanding of ESG can be gained. To explore them, just click on the expandable sections below.

Many corporations, policy-makers and pressure groups (such as minority shareholder watchdogs, environmentalists, civil society NGOs, etc) do recognise the importance of ESG in their daily affairs.

What’s difficult is for corporations (some of which may have been in business for over half a decade or more) to move the needle on their massive, decentralised operations without literally transforming the very core of their business.

Examples of ESG in action: The key to keep in mind are the overall goals and to remember that there is no 'one-size fits all' solution. Most corporations will be aiming for a good balance.

- Greenhouse gas emissions

- Air and water pollution

- Biodiversity

- Deforestation

- Recycling and waste management

- Natural resource use

- Renewable energy

- Water scarcity

- Energy efficiency

- Sustainability initiatives

- Relationships with regulators

- Diversity and inclusion

- Company culture

- Data protection and privacy

- Customer satisfaction

- Relations with local communities

- Human rights

- Labour standards

- Product safety

- Employee training

- Ethical supply chain sourcing

- Board composition

- Management diversity

- Shareholder rights

- Lobbying

- Executive compensation

- Accounting transparency

- Separation of CEO and Chairman roles

- History of shareholder lawsuits

- Employee training

- Relationships with regulators

How astute investors are ESG-ing

How astute investors are ESG-ing

their portfolios

If you think ESG investing is only for the large funds, you’d be partially right. It is hard for individual investors to keep an eye on corporate or market trend that may affect a corporation’s ESG journey.

Even the fact that we’d describe as a ‘journey’ should provide a clear hint - the process of developing strong ESG credentials is a journey of thousands of steps and all of them need a clear, precise careful conductor at the helm.

Large, influential public funds such as retirement funds rely on boardroom access and entire departments of researchers, economists and analysts - this kind muscle is typically beyond the reach of the ordinary investor.

How others are doing this: This is a simplified look at the methods employed by some of the most successful funds to date.

It is a practical place to start when considering ESG investing. We will be looking at this in greater depth in the next article, so do stay tuned.

ESG INVESTING

SUSTAINABLE INVESTING

ESG Integration

“I want to integrate ESG factors to assess the risk/reward profile of my investments.”

PRACTICAL EXAMPLES:

A company’s carbon emissions would be evaluated alongside its fundamental business measures.

Exclusionary Investing

“I want to screen out controversial companies or sectors that do not meet my sustainability criteria.”

PRACTICAL EXAMPLES:

A fund may screen out companies with revenues generated from fossil fuels.

Inclusionary Investing

“I want to invest in companies that attempt to deliver a measurable social and/or environmental impact alongside financial returns.”

PRACTICAL EXAMPLES:

An investor concerned about global warming could tilt their investments to companies with the lowest material carbon risks.

Top performers

Top performers

Impact Investing

“I want to integrate ESG factors to assess the risk/reward profile of my investments.”

PRACTICAL EXAMPLES:

Investing in renewable energy companies with the intent to positively impact the environment.

Donation of product revenues

Donation of product revenues

There’s a twist: As an ordinary investor, you are more powerful than you think.

There’s a twist: As an ordinary investor, you are more powerful than you think.

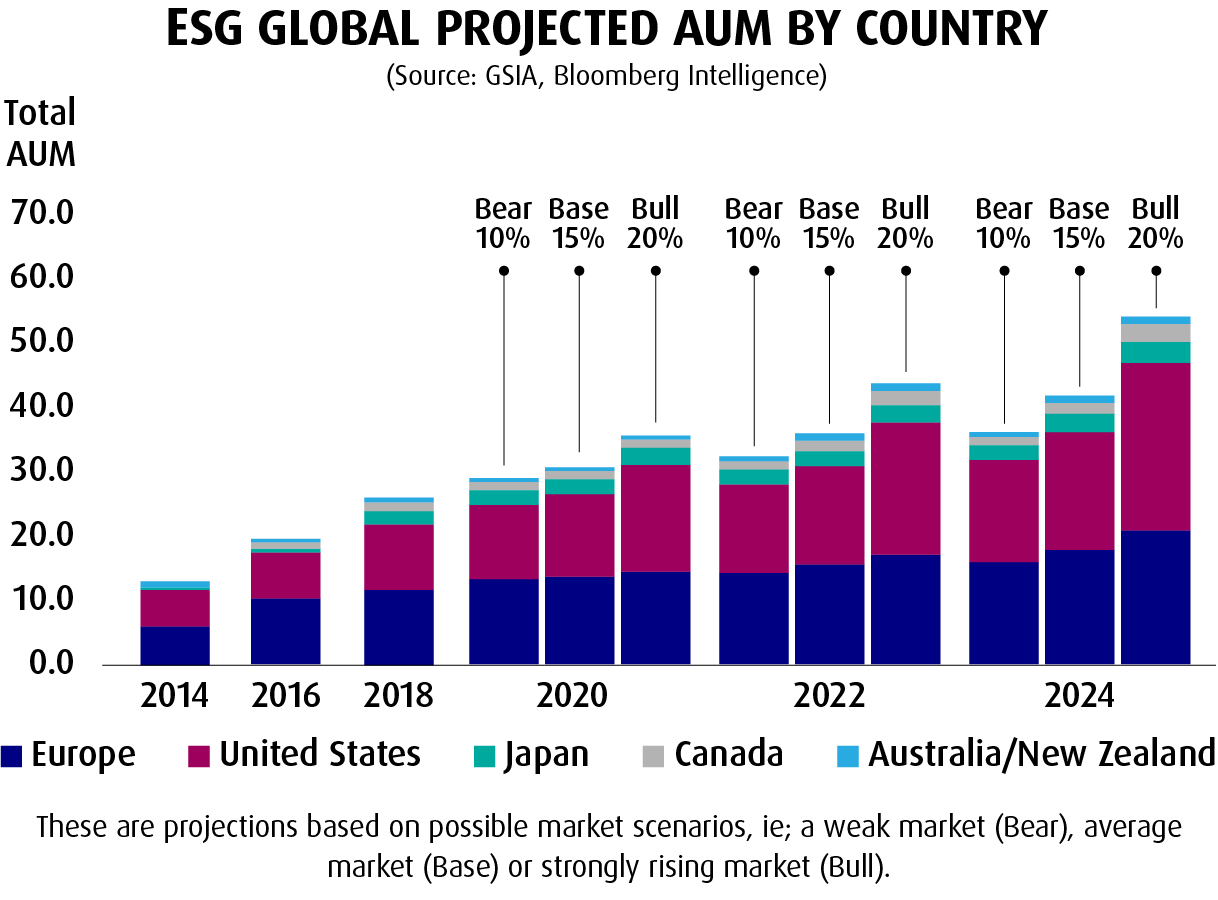

There is now more capital chasing quality ESG investments than there are corporations worthy of consideration. Demand outstrips supply and is driving valuations.

Although individual investors have only a fraction of the capital of the average retirement fund, what they lack in size is made up for in scale - hundreds of thousands if not millions of individual investors around the world have put their investments behind what they believe in, and ESG credentials are at the very heart of it. ESG investing is a movement that is developing momentum and scale that rivals any other form of investing.

Once upon a time, investors were put into neat categories - blue-chip dividend hunters, growth seekers or even high-risk high-return short term investors. Those who lean toward the principles of ESG are a whole new class onto themselves. We’d call them the investors of the future. For those who’ve yet to reposition or rebalance your portfolio in regard to ESG investments, the rush to do so is understandable.

But we believe that a little less haste and a lot more learning is in order for investors to successfully navigate their way through this period. There are many ways to begin your journey toward this goal, and we will be covering some of those in part 2 of this article.

Clearly, there is great scope for expansion. But as more and more capital flows towards these kinds of investments, the question is; are there enough worthy investment targets out there?