Inflation is generally negatively perceived as the ‘rise in prices’. But there’s more that

happens within the complex modern economy. To prepare yourself financially and

effectively re-balance your investments, you need to know where to start thinking.

Inflation is complex and made up of a series of events that can push and pull prices of

everything in an economy upwards or downwards.

Like waves of the ocean, there are always highs and lows — we either learn to

at least float with it, or even better, become a great swimmer.

Inflation is necessary

―

Modern economies need inflation; it drives general growth and progress. It pushes people to improve their skills to earn higher wages, and companies will strive to be better; better products, cost effectiveness and next level technologies that can help drive demand and consumer spending.

Of course, this is based on an ‘ideal’ level of inflation. Too high for too long and it turns into hyperinflation, which destroys economies and livelihoods in a dramatic fashion. Just google the “Zimbabwean Trillion Dollar Billboard” for a sample. When inflation is too low (or even negative!), it’s just as painful. In a deflationary economy, consumers believe things will get cheaper, hence they hold off on spending. Businesses then make less profit and pay less wages (or reduce their workforce) as demand starts to shrink. This cycle feeds upon itself and is hard to break — it's one reason why Japan’s ‘lost decade’ went on for much more than a decade.

Unraveling its complexity

―

Imbalances in supply or demand can drive inflation. ‘Cost-push’ inflation is generally driven by supply shocks such as natural disasters or high production or distribution costs caused by rising oil prices. ‘Demand-pull’ inflation may arise due to an extended stock market rally, when the central bank lowers interest rates or when government raises spending — the resulting rise in demand can stress an economy’s productive capacity, which increases costs that are then passed on to the consumer. Even when neither of these events occur, people or firms may begin anticipating higher prices, and build these higher costs into their wage negotiations and contractual price adjustments (such as automatic rent increases). This too, leads to inflation over time. Sometimes, all of the above can happen almost at the same time.

Can we control it?

―

Many economists believe that controlled and predictable inflation is good for the economy. If it is predictable, it can be captured in price-adjustment contracts and interest rates, and thus reduce its distortionary impact. Central bankers have a policy called inflation targeting — where they aim to keep inflation managed within a determined level over time. Their monetary policies and the government’s fiscal policies both work together to achieve this control.

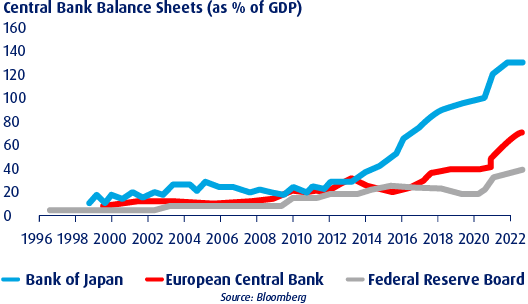

1. The supply of money

Central Bank Balance Sheets (as % of GDP)

Major central banks added significant money supply during the Covid-19 pandemic, driving inflation. However, global central banks have started tightening supply, which may help slow inflation. For context; the addition of money supply began way back during the 2008 financial crisis.

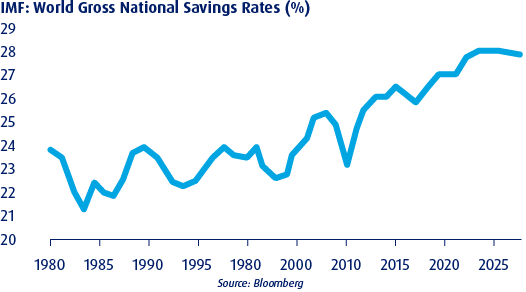

2. Pent-up demand

IMF: World Gross National Savings Rates (%)

While some consumption shifted online, the rate of saving generally expanded during the lock-down. As retail, hospitality and recreational activities resumed, consumer spending rose — driving inflation higher.

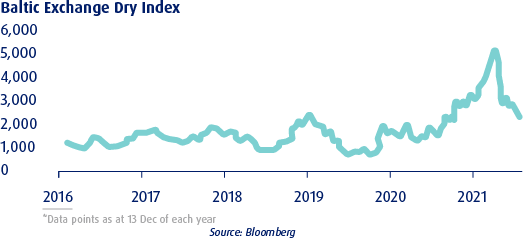

3. Shipping bottlenecks

Baltic Exchange Dry Index

Number of hours for chartered vessels soared as demand for imports recovered amid re-opening. Ports could not manage the extra traffic and ships were getting stuck — lowering supply and driving shipping prices higher.

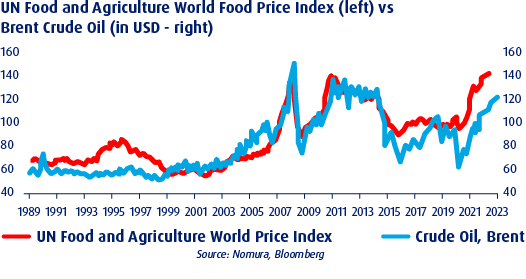

4. Geo-political instability drives food and oil prices

UN Food and Agriculture World Food Price Index (left) vs Brent Crude Oil (in USD - right)

War (even on a smaller scale, contained between two nations) is always a key driver of inflation. Besides the physical damage to productivity, it is also due to wide sanctions that may be imposed. A current example in play; Russia is amongst the world’s largest oil and gas producers. Ukraine is the world’s largest producer of wheat. The result? Food and energy prices keep rising for everyone. The inflationary aspects are likely to remain for longer than the war will.

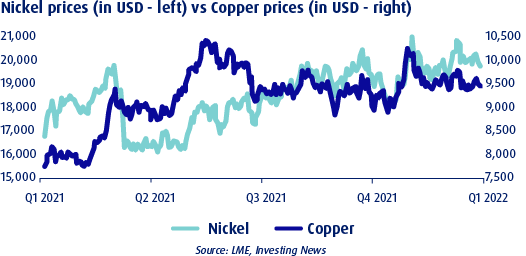

5. Technological advancement drives metal prices

Nickel prices (in USD - left) vs Copper prices (in USD - right)

Proving that there’s no such thing as a free meal, the big efforts over the last decade to move toward clean energy and the storage of that energy in batteries has driven the prices of some rare elements, as well as nickel and copper. Predictably, the many devices in our electronic, digitally driven lives are going to cost more until alternative materials are discovered and used widely.

Investors who hold tangible assets like commodities may enjoy a controlled rise in inflation as their holdings would also rise in price. Rising inflation can lead to more profits as companies pass on input prices to consumers; provided that consumers are willing to spend. These companies will then usually see higher stock prices. Rising inflation also tends to support higher wages. Workers will demand higher pay as prices of goods and services rise, and higher wages usually translate to higher demand and spending.

Those who hold assets denominated in currency, such as cash or bonds, won’t like any inflation at all. It only erodes the value of their holdings. In the past, asset classes that were considered a good hedge against inflation included gold, commodities, and real estate investment trusts (REITs). However, always be aware that the past may not always be a good indicator of what the future holds. It has a habit of changing just when you least expect it. A balanced, thoughtful approach may be your best choice.

1. Equities

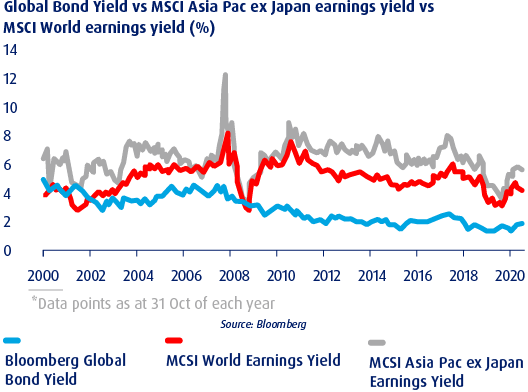

Global Bond Yield vs MSCI Asia Pac ex Japan earnings yield vs MSCI World earnings yield (%)

Equities tend to be relatively stable and a potentially good hedge against inflation for as long as consumers are willing to spend to bear the difference in cost or if companies earn more than what a bond can yield. For example, investors can get higher upside by investing in Asian companies that are earning roughly 5% more than bonds as per the chart above

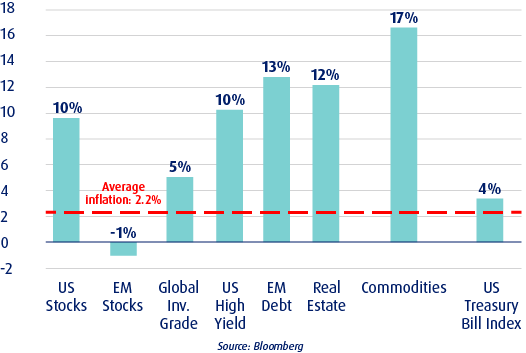

2. Asset classes performance vs inflation (%)

In the last 20 years, US asset classes performed well in a rising high-inflation environment. Global equities should still perform well; the exception being the kind of recessionary or hyperinflation threats last seen in the 1970’s. Commodity prices in emerging markets will continue to edge higher as they are mainly commodity exporters — local prices will follow the rise of global prices.

3. Value vs Growth

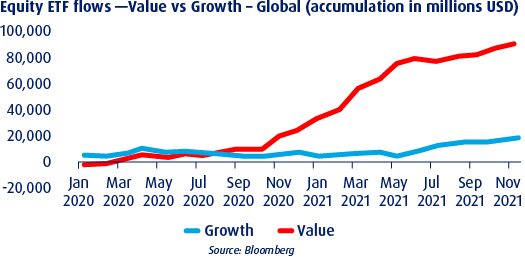

Equity ETF flows —Value vs Growth – Global (accumulation in millions USD)

The value category is usually made up of sectors like financials, energy and materials. These companies may pay regular dividends and may even be currently undervalued. The risk is usually much lower with stable returns. On the other hand, the growth category holds companies that typically don’t pay dividends and instead reinvest retained earnings to expand. They have high potential and equally high risk. Tech companies are good examples.

Value sectors outperformed growth during the recent inflationary cycle. Global investors plowed much more into value stocks since July 2020. However, investors positioning for the longer term should note that growth performed better than value in the past decade.

4. Other sectors

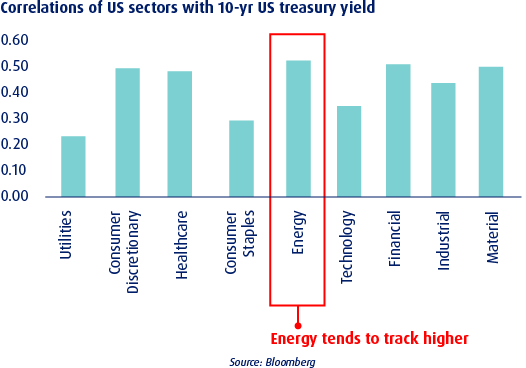

Correlations of US sectors with 10-yr US treasury yield

Higher inflation leads to higher bond yields as investors have to be compensated for inflation. Sectors with higher correlation to US treasury 10-year yields means they perform better when inflation is rising. Energy has been the top performer followed by financials, materials and the rest.

The bottom line

―

Investors can try to anticipate the impact of inflation on their portfolios. In theory, it is possible to hedge against inflation, if your portfolio is adequately diversified within the right sectors.

It’s good to remember, inflation can be a cruel and unfair master; some sectors (unfortunately, even whole segments of society) may suffer more than others, while for some inflation can provide the right pressures to move things their way.

Some of the best advice so far comes from Warren Buffet and Charlie Munger, two of the most famous investors on the planet. According to them, the best thing to do when inflation rises, is to invest in yourself and your skills so that you may command a greater reward for your efforts.

That’s exactly the same with investing while inflation is rising. There is a way to hedge against inflation. And that’s to build your investing skills, observe critically and capture the opportunities that may come your way.