Foreign Exchange, (Forex or FX), is one of the most common things in

the world of finance. It allows you to exchange one currency for another

at any point in time at the most recent prices. Can you invest in it?

Here’s a fresh take on it: It looks complicated, but it really isn’t. If you can

understand it well enough, it’s a good tool that every investor should

know how to make use of. In this article, we’re starting with the basics.

What is Forex,

and where is it used?

Forex stretches far beyond money changers, when you travel overseas,

shop online or even the many expatriates or migrant labourers who send

money home. The Forex market is a lot larger than just that; its part and

parcel of our everyday lives. To give you an idea of the size of the Forex

market, here’s an example:

The container terminal of Hong

Kong processes millions of tonnes

of cargo around the clock. It’s all

paid for by buyers and sellers

across the world using various

currencies. Without Forex, none of

this would be possible.

It’s solely not limited to physical goods, think about corporations or

governments investing in foreign countries or making bond market

repayments, all of this depends on the exchange of currencies. Forex is

pervasive in our modern world - it is everywhere you look.

“The forex market is gigantic:

In 2019, USD $6.6 trillion

was traded per day”

Source: FX markets, The Triennial Central Bank Survey by the Bank for International Settlements.

How some currencies

become as ‘good as gold'

The pre-independance US Dollar:

Over two and a half centuries later,

it’s now the world’s reserve

currency. The strength of currencies

takes time to develop, and is driven

by trust, stability and wide usage in

all kinds of transactions globally.

Currency strength: some key factors to look for

• Healthy supply and demand • Balanced inflation levels •

Well-managed monetary supply (eg: controlled money printing by the central bank)

• Political aspects such as stability, acceptance into Free Trade Agreements or regional unions

• Low corruption or wastage of public funds

Strong currencies are considered ‘safe haven’ currencies you can hold in

volatile times. Based on the factors above, they tend to be stable over time.

Swiss Francs

(CHF)

Strength due to stability

of Swiss government and

financial system.

US Dollars

(USD)

The world’s reserve

currency used by central

banks and financial

institutions internationally

Japanese Yen

(JPY)

Known for high tech,

innovative design of

manufactured goods – an

‘eastern’ alternative to

western currencies

Australian Dollars

(AUD)

The world’s biggest coal

and iron exporter.

Resource-rich, and a

major exporter of

petroleum and gold.*

New Zealand Dollars

(NZD)

The world's biggest

exporter of concentrated

milk. Also exports other

dairy products, meat, and

wool.*

Canadian Dollars

(CAD)

Relies on exports of

natural resources like

timber and fuels. The

price of oil is a major

driver in the economy.

*Source: Observatory of Economic Complexity (OEC)

MYR: The good,

the bad and its future

Malaysia is considered an emerging market – a developing nation that is

transitioning from a low-income nation to a modern, industrial economy

with higher standards of living.

Part of this transition will see both high inflows and outflows of foreign

investments, making the Ringgit a relatively unstable currency.

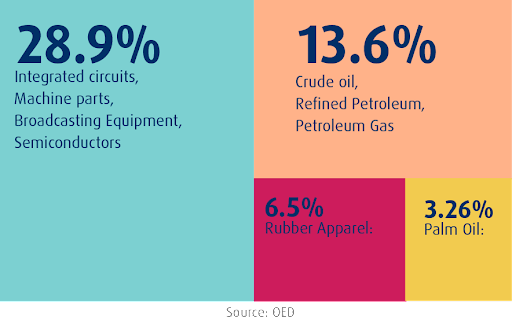

Malaysia’s top four exports:

However, these products and commodities have volatile prices, and in turn,

they affect the volatility of the Ringgit as well.

The volatility of any currency can also driven by political stability and the

ability to withstand geopolitical pressures, resolve corruption scandals and

put in place concrete economic growth plans amongst many other factors.

How much USD or SGD can you buy with RM1?

Over time, we see constant reminders

that the MYR is worth less and less vs

the USD and SGD. For those looking to

protect the value of their savings, it

may be good to diversify your currency

holdings to include strong currencies

like the USD and SGD amongst others.

Time to start

investing in Forex

Forex trading can be a good active strategy for investors. Wise investors use

it to diversify their investments to try to reduce their overall risk. They tend

to monitor and buy into currencies when prices are lower. The forex market is

ideal for this approach as it is highly liquid and has fast-moving trends. As

with all things in investing, if you understand the market you can do well.

Two simple ways to get started:

ONE: Use what you may already have; your HLB account. You can use it to

hold your foreign currencies and even check the latest rates through the HLB

Connect app.

To learn more about opening a foreign currency account, click here!

TWO: When investing in the various funds we offer, many allow you to

denominate your investment in a foreign currency. It’s a simple way to gain

exposure to other currencies. Ask your investment advisor for help!

This article is part of Hong Leong Bank’s educational series, called ‘Fresh Take’.

Here, we seek to present you a fresh, unbiased perspective of all matters financial.

We’ll be uploading more educational content moving forward, so do watch out for

the next piece.

In a world that’s awash with information that may be either true, false or

anywhere in between, Fresh Take aims to cut through the clutter, and help you on

your journey as an investor who’s seeking to build a strong financial future.

Please reach out if you need to know more,

or need personalised help