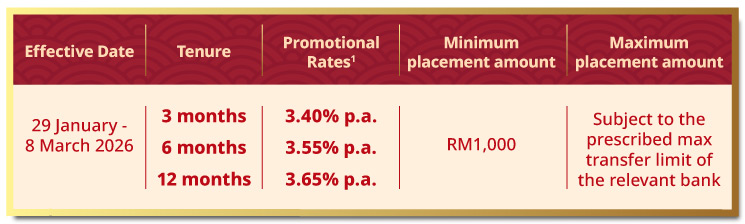

Promotions | HLB Connect | Deposit | 29 January 2026-08 March 2026

Gallop into a year of soaring success with our exclusive Chinese New Year rates designed to give your savings a head start. Just log in to HLB Connect and place a minimum of RM1,000 from your other bank account (FPX).

¹ The Promotional Rate(s) may be revised should there be an Overnight Policy Rate (OPR) change or at the discretion of the Bank with prior notice.

Promotion Period: 29 January - 8 March 2026

Valid for New Funds only. Terms and Conditions apply.

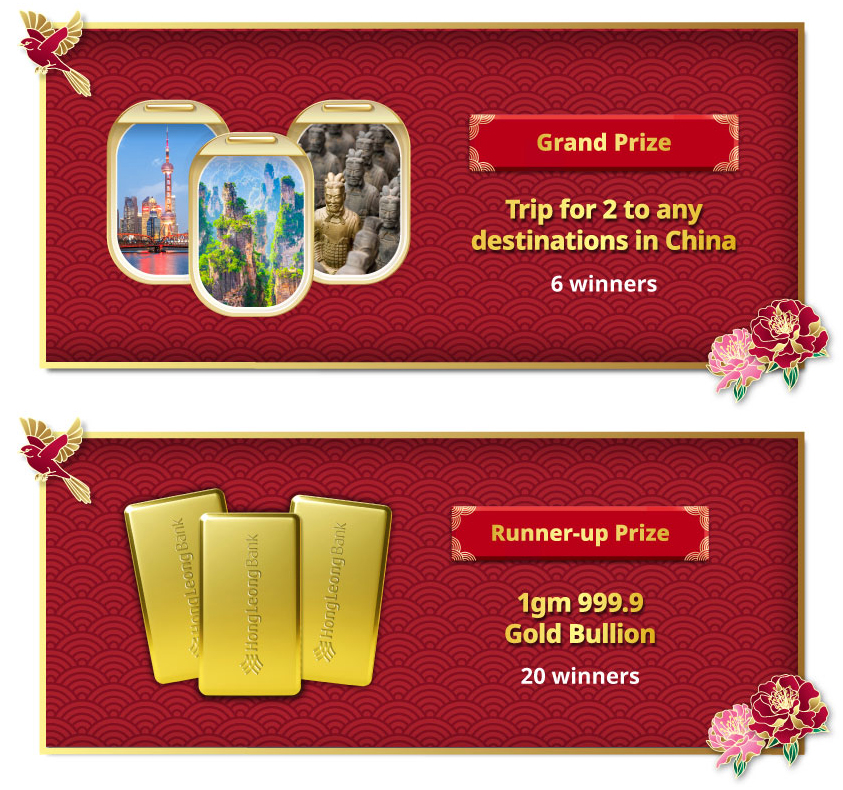

Earn more than just interest or profit.

From now until 3 March 2026, place an eFD/eFD-i on HLB Connect and be one of our top depositors to be in the running to win a trip for two to China or a Gold Bullion. Whether you’re a new or existing customer, you stand an equal opportunity to win.

Promotion Period: 29 January – 3 March 2026

Pictures shown are for illustration purposes only. Valid for New Funds only. Terms and Conditions apply.

The maximum deposit amount per transaction via FPX transfer is RM200,000, subject to such prescribed maximum amount/limit of transfer in the Customers’ individual internet banking maintained with the relevant bank.

*For Joint eFD/eFD-i, both account holders must be above 18 years old and must have an existing Joint CASA/CASA-i under the same names before opening Joint eFD/eFD-i account.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

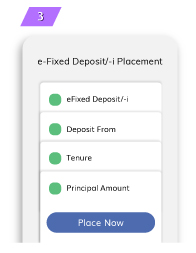

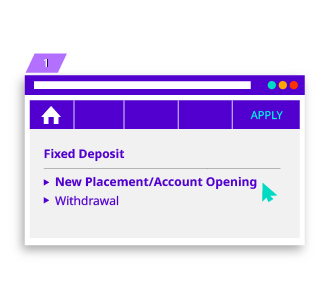

How to place eFixed Deposit/eFixed Deposit-i on HLB Connect

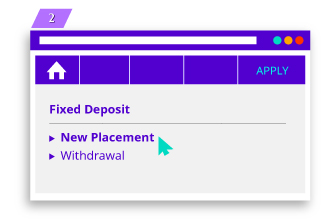

HLB Connect Online

From the Apply menu, under Fixed Deposit, select New Placement

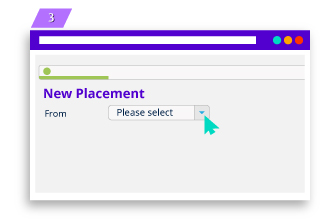

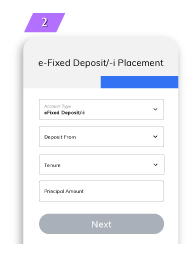

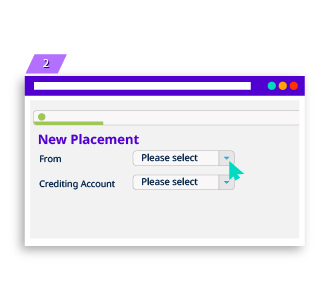

Select your funding bank

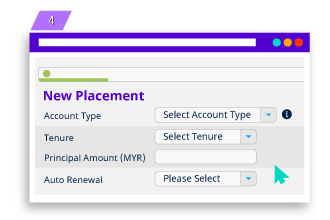

Enter placement details

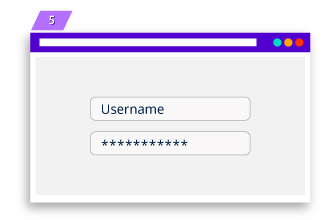

You will be redirected to your funding bank's internet banking login page

Log in and transfer placement funds via FPX

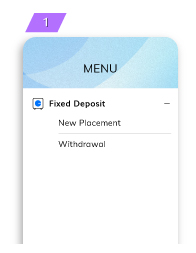

Log in to your Connect App, tap on Menu, Fixed Deposit,

and select New Placement

Enter your new placement details, principal amount and tap on Next

Check your details and tap on Place Now

If you have selected other bank as your funding bank, you will be redirected to your funding bank's page to complete your eFixed Deposit placement

You can now open a Joint eFD/-i account on HLB Connect Online, provided you have an existing Joint Current or Savings Account/-i (Joint CASA/CASA-i) in the same two names with an ‘either one-to-sign‘ operating mandate.

Here’s how you can open one today:

Log in to HLB Connect Online.

Navigate to Apply, Fixed Deposit & New Placement/Account Opening.

Under From, select your funding bank.

Under Crediting Account, select your Joint CASA/-i where principal & interest will be paid.

Click Next.

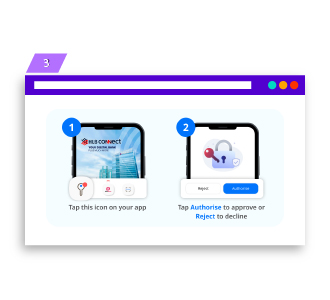

Approve the AppAuthorise notification sent to your HLB Connect App.

The other account holder will be notified through in-app message/email.

He/She must log in to HLB Connect Online, click View Request & Approve within 7 calendar days.

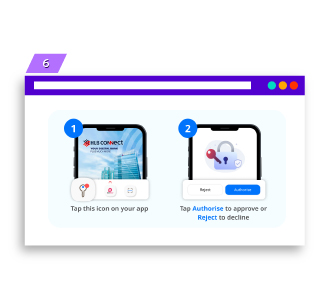

AppAuthorise will then be sent to his/her HLB Connect App. He/She must approve it before you can make a placement.

Your placement can be made immediately after you receive the confirmation email on your Joint eFD/-i account opening.