These may interest you

Features & Benefits

- Open to individuals aged 18 years and above (available for single name or joint names).

- Placement and withdrawal can be made via HLB Connect.

- Account and placement details can be viewed upon successful placement.

- Interest payout upon maturity. Effective 01 January 2019, no interest shall be payable on partially withdrawn amount and/or premature withdrawal of eFD.

- Flexibility to make partial withdrawal and still earn interest on remaining balance (partial withdrawal must be in made in multiples of RM1,000)

- Maximum of two (2) account holders for Joint eFD with operating mandate of either one-to-sign.

Eligibility

- Minimum deposit of RM5,000 for 1 month placement or RM500 for 2 months and above.

- For individuals aged 18 years and above with Current Account/-i or Savings Account/-i.

- For Joint eFD, account holders must have a Current Account/-i or Savings Account/-i in the same names and operating mandate of either one-to-sign.

More details

Less details

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

You can now open a Joint eFD/-i account on HLB Connect Online, provided you have an existing Joint Current or Savings Account/-i (Joint CASA/CASA-i) in the same two names with an ‘either one-to-sign‘ operating mandate.

Here’s how you can open one today:

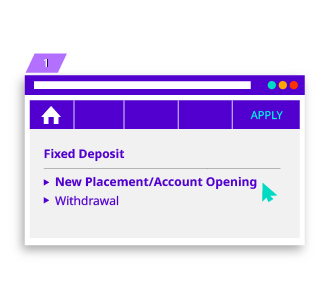

Log in to HLB Connect Online.

Navigate to Apply, Fixed Deposit & New Placement/Account Opening.

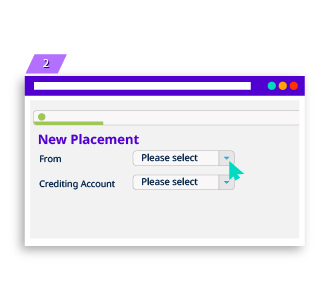

Under From, select your funding bank.

Under Crediting Account, select your Joint CASA/-i where principal & interest will be paid.

Click Next.

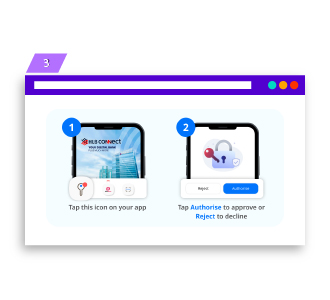

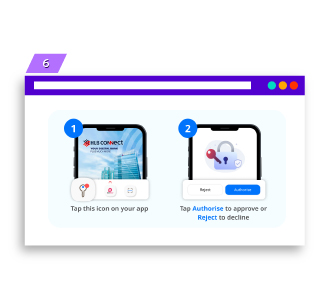

Approve the AppAuthorise notification sent to your HLB Connect App.

The other account holder will be notified through in-app message/email.

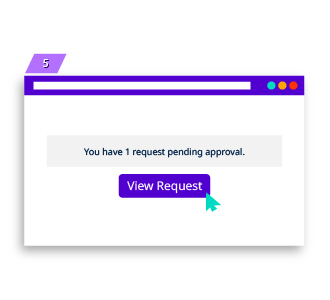

He/She must log in to HLB Connect Online, click View Request & Approve within 7 calendar days.

AppAuthorise will then be sent to his/her HLB Connect App. He/She must approve it before you can make a placement.

Your placement can be made immediately after you receive the confirmation email on your Joint eFD/-i account opening.

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

| Tenure | Interest Rates (p.a.) |

|---|---|

| 1 month | 1.60% |

| 2 months | 1.75% |

| 3 months | 1.95% |

| 4 months | 2.00% |

| 5 months | 2.00% |

| 6 months | 2.05% |

| 7 months | 2.05% |

| 8 months | 2.05% |

| 9 months | 2.05% |

| 10 months | 2.05% |

| 11 months | 2.05% |

| 12 months | 2.05% |

| 13 - 60 months | 2.10% |

Important notice

Please click HERE for the exhaustive list of fees and charges.