These may interest you

FEATURES & BENEFITS

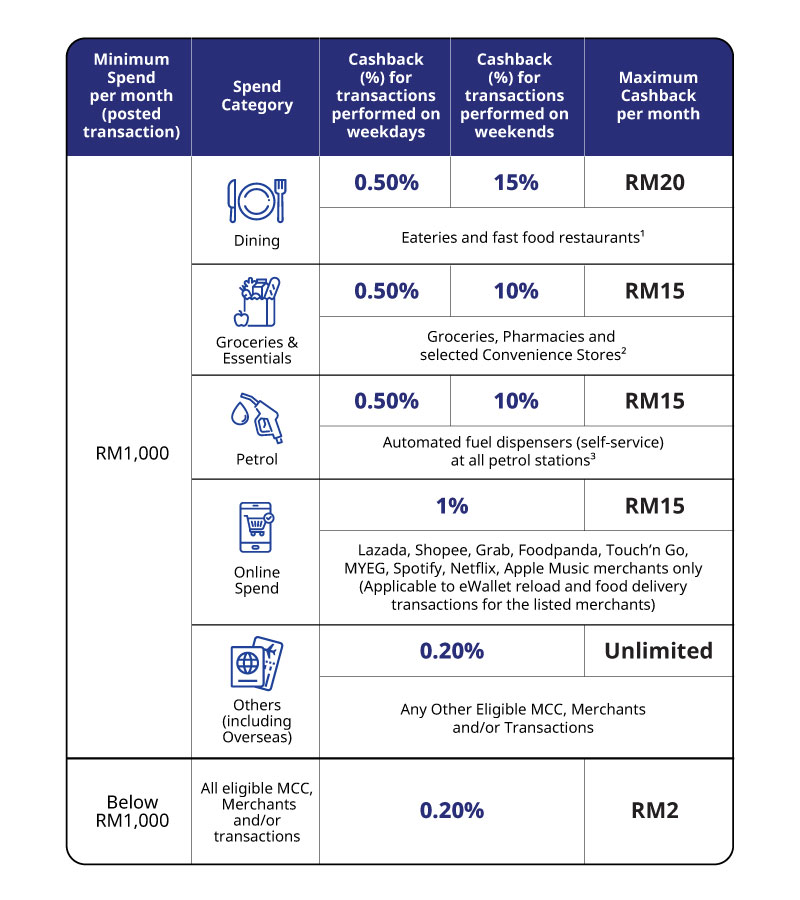

Enjoy up to 15% cashback on Dining, Groceries, Pharmacies, Petrol, Online spend & eWallet reload. What is more, enjoy 0.2% unlimited cashback on other eligible transactions (including Overseas, Insurance and more).

Eligibility

- Aged 21 to 65 years old (Principal) | 18 years old (Supplementary)

- Minimum annual income of RM24k

OR a minimum fixed deposit pledged of RM2,000

More details

Less details

Wise up and make the Wise move

Enjoy up to 15% cashback on Dining, Groceries, Pharmacies, Petrol, Online spend, eWallet reload and more. Just meet a minimum retail spend of RM1000 on HLB Wise Credit Card (per month).

¹Merchants within MCC 5811, 5812, 5814 only

²Merchants within MCC 5411, MCC 5912 and selected convenience stores (MyNews & 7-Eleven only)

³Merchants within MCC 5542 only

*All Government/JomPAY/FPX bill payment related transactions, QR Pay transactions via HLB Connect App, Cash Advances, Quasi Cash (betting and gaming related transactions), Quick Cash, Flexi Payment Plan, Auto Balance Conversion (ABC), Balance Transfers and any fees and charges are not eligible for cashback.

Click here for the list of fees and charges, or visit any of our branches for further information.

Q: How are Weekends and Weekdays defined?

A: Weekdays refer to Mondays to Fridays whilst Weekends refer to Saturdays and Sundays.

Q: How do I qualify for the up to 15% cashback on the spend categories as per Table 1 above?

A: You must meet the minimum spend of RM1,000 (posted transactions) for the month.

Q: If I performed a Petrol transaction on a Sunday and the transaction posted on the following day which is a Monday, will I enjoy 0.5% or 10% cashback on Petrol?

A: You will enjoy 10% cashback because you performed the transaction on a Weekend. Subject to meeting a minimum monthly spend of RM1,000 (posted transactions) and the cashback is within the RM15 monthly capping.

Q: How is cashback calculated?

A: Cashback is calculated based on the spending transaction date. Please refer to the sample illustration below for more information.

Illustration A – Meet Minimum Monthly Spend of RM1,000

|

Spend Category |

Transaction Date |

Posting Date |

Spend

|

Cashback Rate(%) |

Cashback

|

Monthly Cashback Capping (RM) |

|---|---|---|---|---|---|---|

|

Dining |

25/08/24 |

26/08/24 |

135 |

15% |

20 |

20 |

|

Groceries & Essentials |

11/08/24 |

11/08/24 |

150 |

10% |

15 |

15 |

|

Petrol |

11/08/24 |

11/08/24 |

150 |

10% |

15 |

15 |

|

Online Spend (Including eWallet Reload) |

15/08/24 |

15/08/24 |

1500 |

1% |

15 |

15 |

|

Overseas Spend |

23/08/24 |

23/08/24 |

100 |

0.20% |

0.20 |

Unlimited |

|

Others |

23/08/24 |

23/08/24 |

100 |

0.20% |

0.20 |

Unlimited |

|

Total Cashback Earned (RM) |

65 |

|||||

Illustration B – Monthly Spend Below RM1,000

|

Spend Category |

Transaction Date |

Posting Date |

Spend

|

Cashback Rate (%) |

Cashback

|

Monthly Cashback Capping (RM) |

|---|---|---|---|---|---|---|

|

Dining |

25/08/24 |

25/08/24 |

50 |

0.20% |

0.1 |

2 |

|

Groceries & Essentials |

11/08/24 |

11/08/24 |

100 |

0.20% |

0.2 |

|

|

Petrol |

18/08/24 |

18/08/24 |

150 |

0.20% |

0.3 |

|

|

Online Spend (Including eWallet Reload) |

15/08/24 |

15/08/24 |

150 |

0.20% |

0.3 |

|

|

Overseas Spend |

23/08/24 |

23/08/24 |

100 |

0.20% |

0.20 |

|

|

Others |

23/08/24 |

23/08/24 |

50 |

0.20% |

0.1 |

|

|

Total Cashback Earned (RM) |

1 |

|||||

English

Bahasa Malaysia