HLB Connect App

HLB Connect App

The only banking app you need. From account opening, day-to-day transfers/payments to monitoring your unit trust account, enjoy a seamless banking experience with an enhanced look and feel and navigation that puts you in control anytime, anywhere.

See what’s new on HLB Connect App:

We have also improved these features, just for you:

HLB Connect registration & account opening at your fingertips

Say goodbye to queues and paperwork. Register for HLB Connect or open an HLB account anytime, anywhere.

Log in to HLB Connect App effortlessly

If you have set-up the app and have biometric settings enabled on your device, for your next login the app will auto-detect based on your biometric or face ID. You no longer need to tap on any login icon to proceed.

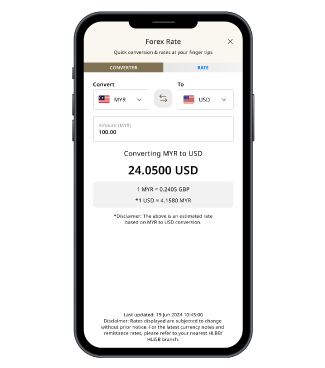

Converting your money between currencies is fast

We will show you how much your money is worth in other currencies with no hidden fees and at competitive exchange rates. Try it now!

Download or update HLB Connect App today

HLB Connect Online Banking and Mobile Banking App

HLB Connect users have access to various services and features offered within the online banking and mobile banking platforms. Click on the + to view the list of available services and features.

Real-time Transaction Updates

Get instant updates of your last 15 Debit and Credit Card transactions from the last 7 days.

Mobile Alerts

Get transaction notification, service updates, and the latest promotion sent directly to your app inbox.

Foreign Currency Deposit

Convert and save up to 12 Foreign currencies within 1 account. You can spend the converted amount for overseas online or debit card payments.

Fund Transfer

Send money locally to recipient via Account/Mobile/NRIC/Passport/Business Registration number with zero fees.

Connect ATM Withdrawal

Use HLB Connect App to withdraw cash from any HLB ATM without a Debit Card.

Overseas Transfer

Send money overseas with lower fees and conveniently from wherever you are.

Bill Payments

Make online payment to all major Billers in Malaysia. You can also pay up to 5 favourite Billers at one go on HLB Connect App.

Junior Debit Card Reload

Auto reload for free from your account to your children’s Junior Debit Card via HLB Connect Online.

Quick Pay

A shortcut to pay or transfer funds to the latest recipients in 3 simple steps. Just enter the amount and send.

Prepaid Reload

A service that allows you to perform immediate top-up for prepaid mobile (Celcom, DiGi, Hotlink, U Mobile and more), or other prepaid services (Game Credits, IDD & STD, Movie Subscription and more).

QR Pay & Receive QR Payment

Make a payment by scanning a QR code through your HLB Connect App, or generate your QR code to receive payment.

ASNB Investment

Keep track of your account balance or top-up funds conveniently anytime, anywhere.

Cross-Border QR

You can make QR Payments by scanning PromptPay (Thailand), QRIS (Indonesia), NETS (Singapore) & Bakong (Cambodia) QR Code using QR Pay feature in HLB Connect App

Google Pay

Add your HLB Credit or Debit Card/-i to make secure contactless payments using your Android devices.

eFixed Deposit/-i

Make an online deposit using funds from an HLB Account or another bank and enjoy competitive rates

Credit Card

Apply for a new HLB Credit Card online in 5 minutes, or apply for an additional card with instant approval.

Share Trading Account

Apply and link your Pay&Save Account/-i with your Trading Account and manage your investment portfolio anytime, anywhere.

Credit Shield Premier

Protect your credit card outstanding balance from RM0.65 per month.

3-in-1 Junior Account

Apply online for the only children’s account equipped with a Savings account, a reloadable Debit Card and a high interest/profit Fixed Deposit account.

Quick Cash

Get extra cash within your HLB Credit Card limit. Apply online for instant approval, and receive funds in your HLB Account the next business day.

Balance Transfer

Apply to transfer your Credit Card balance from another bank to your HLB Credit Card.

Flexi Payment Plan

Easily convert your big purchases into smaller monthly instalment plans on your HLB Credit Card.

Activate Credit Card

Activate your new HLB Credit Card conveniently online from the comfort of your home.

Report Lost/Stolen Card

In a case of emergency, you can report and block your lost or stolen Debit/Credit Card immediately to protect your account.

Freeze/Unfreeze Credit Card

Misplaced your card? Freeze or unfreeze conveniently online with just a tap and enjoy a peace of mind.

Increase Credit Limit

Temporarily increase your Credit Card limit with instant approval, or request for a permanent increase in credit limit.

Notify Overseas Travel

Inform the bank of your impending overseas travel to prevent usage disruption.

Credit Card Replacement

Request to replace your lost/damage card conveniently via HLB Connect.

Debit Card Setting

Manage your Debit Card usage and also enable your card for Overseas Transactions, Auto Debit and Internet Purchases.

Manage QR Pay Setting

If you have multiple Current or Savings Account/-i, you can easily set the preferred account to make and receive QR payments.

Debit Card/-i Renewal

Request to renew your expiring debit card/-i conveniently via HLB Connect 3 months ahead of the actual expiry date and the card will be delivered to your address.

Junior Debit Card Services

Apply, activate or renew your child’s Junior Debit Card conveniently on HLB Connect Online.

Refund of Overpayment

Overpaid your credit card? Get a refund of up to RM1,000 directly into your HLB account or offset your second HLB credit card.

Card Fee Waiver

Enjoy Credit Card fee waiver by applying for it on HLB Connect.

Customers with eligible credit cards that have met the set requirement will see the ‘Apply For Waiver’ button when they log in to HLB Connect.

Debit Card/-i Replacement

Request to replace your lost/damage card conveniently via HLB Connect.

Activate Debit Card/-i

Activate your new card conveniently via HLB Connect so you can start using it.

Link Your Preferred Account with Debit Card/-i

If you have multiple Current or Savings Account/-i, you can easily link your preferred account to your card to fund your retail purchases, ATM withdrawals and card payments.

Set Debit Card/-i Transaction Limit

You can conveniently set daily limit for your card’s online purchases, local and overseas retail purchases, ATM withdrawals and ATM transfers limit for your debit card via HLB Connect.

Credit Card OTP via HLB Connect App

Conveniently retrieve your Credit Card OTP by taping on the 'bell icon' on the top left of the app screen.

Transaction Limits

Set daily limits for different transaction types and for transactions without TAC so you can decide if you want TAC authorisation for non-favourite transfers of any amount.

App Language

Choose your preferred language for your HLB Connect App.

DuitNow ID

Register or update your DuitNow ID with HLB to receive money using easy-to-remember DuitNow IDs such as Mobile number (as well as MyKad/Passport/Business Registration number).

App Theme & Shortcuts

Choose between light and dark display themes, and customize shortcuts to access your favourite functions.

Manage the settings of your kid’s Pocket Connect App directly from your HLB Connect Online.

You can reload pocket money into their debit card, approve their pocket money requests, assign them task to earn pocket money, monitor their debit card transactions and more.

How It Works:

Step 1: Log in to HLB Connect Online.

Step 2: Click on ‘Pocket Connect’ on the right side of the top navigation menu.

Biometric Authentication

Log in to your HLB Connect App quickly and securely using Fingerprint or Face ID authentication.

AppAuthorise

An additional security feature to authorise payments or transfers (performed on HLB Connect Online/App) that used to require SMS TAC.

App Binding

An added security measure to ensure that your login details can only be used to access HLB Connect App that has been bound/linked to your mobile device.

Security Picture

Security picture helps confirm that validity of the login screen. When you log in to HLB Connect, you should only enter your password if you see your security picture.

Reminder: Your security picture should not be shown to anyone.

Request Security Documents

You can request for a copy of your Mortgage/Property Financing-i security documents via HLB Connect Online.

Start Early Instalment

You can request to start early instalment for your interest/profit servicing Mortgage/Property Financing-i account. This can help reduce your interest/profit payment.

Increase Instalment Amount

You can request to increase the amount of your Mortgage/Property Financing-i monthly instalment. This can help reduce your interest/profit payment and tenure.

HLB Connect users can perform the following transactions up to the specified daily transaction limit.

Example: Combined Daily Limit for QR Payment, Third Party HLB account, DuitNow and IBG is RM50,000 (for HLB Connect users of 18 years old and above). If your total transaction value from any or all of these have reached RM50,000, you will not be able to make any more transactions from this group until the following day. However, you will still be able to make transaction from other transaction types that are not sharing the Combined Daily Limit e.g. FPX, Bill Payments, Prepaid Reload, etc.

A default limit will be set for all users. To increase or reduce this default daily transaction limit, please follow these steps:

-

HLB Connect App: Tap on Menu > Tap on ‘Account Settings & Limits’ > Tap on ‘Transaction Limits’ > Tap on ‘+’ to expand the relevant section and update your limit accordingly

-

HLB Connect Online: Click on ‘Settings’ > click on ‘Change Online Transaction Limits’

| Combined Daily Limit | Transaction Types | Daily Limit for 18 and above | Daily Limit for Below 18 |

|---|---|---|---|

|

For 18 years old and above: the maximum combined value from all these transactions types is RM50,000 daily.

For below 18 years old: the maximum combined value from all these transactions types is RM200 daily. |

FPX (Merchant Specific) | RM50,000 | Not applicable |

| FPX (Non-Merchant Specific) | RM30,000 | Not applicable | |

| DuitNow Online Banking/Wallets | RM50,000 | Not applicable | |

| Connect ATM Withdrawal | RM1,500 | RM100 | |

| Prepaid Reload | RM200 | RM100 | |

| Junior Debit Card Reload | RM5,000 | Not applicable | |

|

For 18 years old and above: the maximum combined value from all these transactions types is RM50,000 daily.

|

QR Payment (within Malaysia) Maximum daily limit for QR Pay is RM9,999. You can set your own limit of up to RM250 per transaction for QR Pay without authentication. Authentication in the form of password or biometric will be required when you exceed the limit you’ve set. |

RM9,999

|

RM200 |

|

Cross-Border QR Maximum daily limit for Cross-Border QR is RM9,999. This limit is shared with QR Pay (for QR payments within Malaysia)’s daily limit. Maximum limit per transaction is RM3,000. |

RM9,999 | RM200 | |

| Third Party HLB Account | RM50,000 | RM200 | |

| Transfer to other bank (via DuitNow or GIRO) | RM50,000 | RM200 | |

| The maximum combined value from all these transactions types is RM50,000 daily. | Bill Payment | RM50,000 | Not applicable |

| Other Retail Payment (non-FPX or non-DuitNow Online Banking/Wallets) | RM30,000 | Not applicable | |

| The maximum combined value from all these transactions types is RM50,000 daily. | ASNB Subscription to Own/Minor Account | RM50,000 | Not applicable |

| ASNB Subscription to 3rd Party Account | RM25,000 | Not applicable | |

|

Overseas Transfer The transfer limit for single transaction varies according to your resident status, relationship with recipient and the purpose of transfer.

|

RM200,000 | Not applicable | |

| HLeBroking Transfer | RM1,000,000 | Not applicable |

This may interest you

1st Pocket Money App in Malaysia

Watch this video to see how your child will learn to earn, spend and save responsibly while they manage their pocket money with HLB Pocket Connect App.

Get quick answers to frequently asked questions here.

For seamless access to HLB Connect (mobile and online banking), please ensure your registered mobile number and email address are up-to-date with the bank. You'll need them to receive security codes for quick registration, app setup, and any necessary resets.

If these details are not yet registered or require updating, please visit any HLB branch.

Need help? Please watch the following videos:

How to register for HLB Connect

For registration, you will need your Temporary ID, HLB Connect Code, and either your account number or credit card number.

How to set up HLB Connect App

To set up the HLB Connect App on your device, you will need your HLB Connect Code and Device Activation Code.

Important: Moving to a new phone? Remember to unlink the HLB Connect App from your current device before setting it up on your new one.

Here’s how: Login > Tap on ‘Menu’ > ‘App Settings’ > ‘Device & Notifications’ > ‘Remove’

How To Reset HLB Connect

For HLB Connect access reset, you will need your Temporary ID, HLB Connect Code, and your account number or credit card number.

For Existing HLB Connect App users follow these steps: Enter your ID > enter HLB Connect Code > authenticate with AppAuthorise > enter Account/Card number and existing username for verification > enter your new password

HLB Connect Security Features

Starting 17 October 2025, biometric (face ID or fingerprint) verification will be required when you do any of the following:

-

View your card OTP or CVV via HLB Connect App

-

Use AppAuthorise to approve monetary transactions initiated from the HLB Connect App or Online

You will automatically enjoy this added security measure if biometric is already enabled in your app setting.

If you are yet to enable biometric in your app settings or have disabled it recently, you may activate the security feature using the following steps:

Tap on MENU > App Settings > Enrol Fingerprint/Enrol Face ID

As part of our on-going security measures and to align with the banking industry direction, HLB Connect App will be enabled with a security feature to protect customers from malware scams. Read more here.

AppAuthorise is a security feature required to authorise payments/transfers performed on HLB Connect. With AppAuthorise, you can enjoy one-tap approval using the HLB Connect App. Learn more about AppAuthorise and how to enable it

Important Updates:

- Starting 17 July 2023, SMS TAC is replaced by AppAuthorise. All online payments/transfers now require AppAuthorise approval.

- Starting 25 June 2024, AppAuthorise is also required for transactions over RM10,000, including:

- Payments/Transfers to your own HLB account e.g. Bank Account, Credit Card, or Loan/Financing-i

- Payments/Transfers to your favourites via 3rd Party Transfer, IBG, DuitNow to Account, DuitNow to Proxy and Bill Payment

- Currency conversion using the Multi-Currency Feature

- e-Fixed Deposit/-i placement

- Subscription or top-up to your Investment Account-i or Unit Trust account

Cooling-Off Period is an enhanced security measure to protect your account and this will take effect when you do the following:

A. Setting up HLB Connect App and enabling AppAuthorise on a new device

Starting 25 November 2023, AppAuthorise will be enabled 12 hours after you activate HLB Connect on a new device. This Cooling-Off Period provides enhanced security, aligning with industry best practices to protect you from evolving online banking fraud. You will be able to authorise transactions using AppAuthorise once this period is complete.

B. Changing your daily transaction limit to a higher limit on HLB Connect

Starting 16 March 2023, your new transaction limit will take effect after a 1-hour "Cooling-Off Period". During this period, you can still transact within your existing limit.

If you make another request to increase the limit before the first Cooling-Off Period is over, the timer will start all over again.

C. Updating your contact details on HLB Connect

Starting 25 June 2024, any changes to your contact details such as email address, bank account or credit card details will take effect after the 1-hour Cooling-Off Period is over.

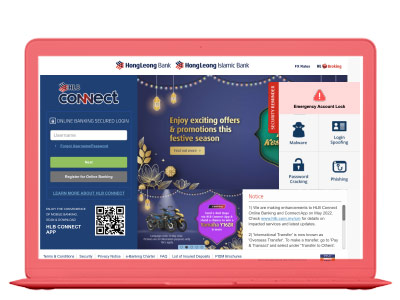

Emergency Lock is a handy feature that you can activate when you suspect that you’ve fallen victim to a scam or your HLB Connect access has been compromised.

When you activate this feature, all new transactions on HLB Connect will be blocked (except for scheduled instructions/recurring transactions that have been set before you activated this feature). You will still be able to access your HLB Connect Online & App to view your account balance. Your credit or debit card/-i transactions outside of HLB Connect will not be impacted by this feature.

Please contact us immediately at 03 7626 8899 after activating this feature to get guidance on the next steps.

Emergency Lock is available on HLB Connect App and HLB Connect Online starting 16 March 2023. You can locate it here:

At HLB Connect App login screen, tap on the ‘Emergency Lock’ icon

At HLB Connect Online website login page, click on ‘Security Reminder’ tab located on the top right

Outdated Operating System (OS) weaken your mobile phone/device’s resistance to malware and virus attacks. You should always ensure the mobile phone/device you use to access HLB Connect App is on the latest OS version.

Important: Notice Regarding iOS Beta Software

To ensure security and stability of the HLB Connect App, we advise to use only the official iOS versions released by Apple. Pre-release software, such as iOS 26 Beta, may cause issues and disrupt your mobile banking experience.

Starting 18 March 2025, to access HLB Connect App, your Apple mobile phone/device must be running on iOS 15 and above or Android/Huawei mobile phone must be running on Android OS 10 and above.

To update your mobile phone/device OS, please refer to your respective device OS update settings:

- For iOS users: https://support.apple.com/en-my/guide/iphone/iph3e504502/ios

- For Android users: https://support.google.com/android/answer/7680439?hl=en

Here is an overview of the Android and iOS versions:

| Android | Released | Google Security Support |

|---|---|---|

| 16 | 10 June 2025 | Yes |

|

15 |

3 Sep 2024 |

Yes |

|

14 |

4 Oct 2023 |

Yes |

|

13 |

15 Aug 2022 |

Yes |

|

12 |

7 Mar 2022 |

Yes |

|

11 |

8 Sep 2020 |

Ended on 5 Feb 2024 |

|

10 |

3 Sep 2019 |

Ended on 6 Mar 2023 |

|

9 |

6 Aug 2019 |

Ended on 1 Jan 2022 |

Last updated on 19 December 2025

| iOS | Released | Apple Active Support | Apple Security Support |

|---|---|---|---|

| 26 | 15 Sep 2025 | Yes | Yes |

|

18 |

16 Sep 2024 |

Yes |

Yes |

|

17 |

18 Sep 2023 |

Ended on 18 Sep 2024 |

Ended on 19 Nov 2024 |

|

16 |

12 Sep 2022 |

Ended on 18 Sep 2023 |

Ended on 7 Aug 2024 |

|

15 |

20 Sep 2021 |

Ended on 12 Sep 2022 |

Ended on 16 Sep 2024 |

|

14 |

16 Sep 2020 |

Ended on 20 Sep 2021 |

Ended on 1 Oct 2021 |

|

13 |

19 Sep 2019 |

Ended on 16 Sep 2020 |

Ended on 16 Sep 2020 |

|

12 |

17 Sep 2018 |

Ended on 19 Sep 2019 |

Ended on 23 Jan 2023 |

Last updated on 19 December 2025

Click below for FAQ

As part of our enhanced security measure, email address is required for some HLB Connect transactions.

To update your email address, please follow the steps below:

1. Log in to HLB Connect Online

2. Click on ‘Settings’

3. Click on ‘Update Contact Info’

4. From the drop down menu, select ‘Notification Email Address’

5. Enter your email address, confirm the email address and click ‘Next’

IMPORTANT: For safety measures, never share your email address with anyone.

As an enhanced security measure, starting September 2022, you will be able to access HLB Connect App on ONLY ONE device.

If you have other devices previously linked to your HLB Connect App, they will be removed. If you do not have access to your device, please call our HLB Contact Centre at +603 7626 8899 to remove the device from your HLB Connect App.

Starting 29 September 2022, only one mobile number can be linked to one HLB Connect user.

For the safety of your account, please ensure the mobile number you register with the bank is updated.

If you have a new mobile number, please update it using one of these methods:

- Call our HLB Contact Centre at +603 7626 8899 (if you are residing outside of Malaysia)

- Visit any HLB branch nearest to you

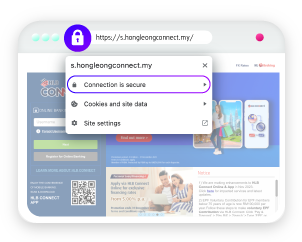

A. How to ensure you are on the official HLB Connect Online website

When you are directed to HLB Connect Online website, follow these steps to verify that it is really HLB Connect Online Website.

For security reasons, make sure your devices' web browsers are up to date whenever you access HLB Connect Online. Outdated web browsers may contain unpatched security flaws that malicious actors can exploit to compromise your device and steal your personal and financial information.

Step 1:

Click/tap on lock icon on the browser’s address bar

Step 2:

Click/tap on ‘Connection is Secure’

Step 3:

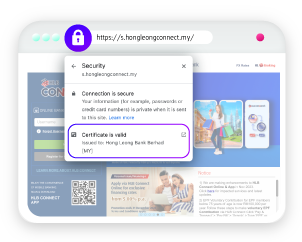

Ensure these information are displayed: ‘Certificate is valid’ and ‘Issued to: Hong Leong Bank Berhad [MY]’

Note: This is applicable when you are browsing on a computer. Different web browsers may have variations in their user interfaces and settings, which may require different steps to obtain this information.

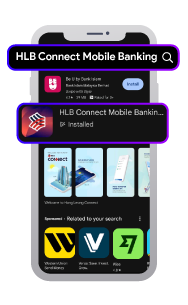

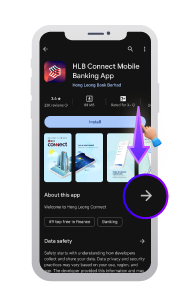

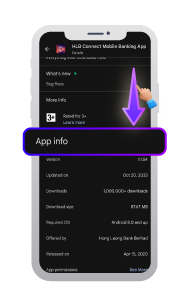

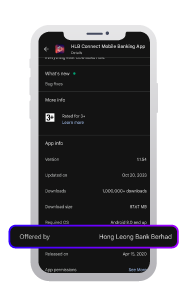

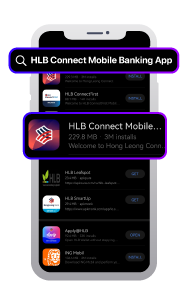

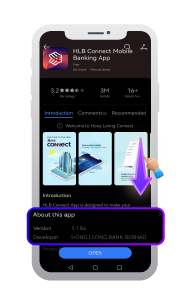

B. How to ensure you are downloading the right HLB Connect App

You should only download HLB Connect App from the authorised app stores – Google Play Store, Apple AppStore and Huawei AppGallery.

NEVER download any app from unsolicited links.

End-of-support mobile operating systems (OS) may not get updated with the latest security patches. It is critical to keep your mobile device's OS up to date in order to protect your device and data.

Before you tap to download the app, follow these steps to verify that it is the official HLB Connect App.

Step 1:

Search ‘HLB Connect Mobile Banking App’. Tap on our logo.

Step 2:

Scroll down to 'About this app’ and tap the arrow symbol.

Step 3:

Scroll down to 'App Info'

Step 4:

Ensure the ‘Offered by’ is 'Hong Leong Bank Berhad'

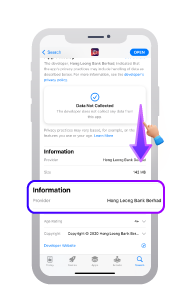

Step 1:

Search ‘HLB Connect Mobile Banking App’. Tap on our logo.

Step 2:

Ensure the ‘Developer’ is 'Hong Leong Bank Berhad’

Step 3:

Scroll down to ‘Information’ and ensure the ‘Provider’ is 'Hong Leong Bank Berhad'

Step 1:

Search ‘HLB Connect Mobile Banking App’. Tap on our logo.

Step 2:

Scroll down to ‘About this app’ and ensure the ‘Developer’ is 'Hong Leong Bank Berhad'

To keep your HLB Connect Online secure, please ensure your browser is up-to-date. Using the latest version helps protect you from viruses, malware, and other online threats.

Starting January 2026, HLB Connect Online will only be accessible through the minimum browser versions listed below. If you're using an older version, you'll need to upgrade to avoid any disruption to your online banking.

Please check the table below to see the minimum required versions. If you need to upgrade, visit your browser's official website to download the latest version.

|

Type of Web/Mobile Browser |

Minimum Version for Desktop |

Minimum Version for Mobile |

|---|---|---|

|

Apple Safari |

17.5 and above |

17.5 and above |

|

Google Chrome Google Search App |

136 and above |

136 and above |

|

Samsung Browser |

N/A |

24 and above |

|

MIUI Browser |

N/A |

18.4 and above |

|

Huawei Browser |

N/A |

15.0.7.301 and above |

|

Microsoft Edge |

136 and above |

136 and above |

|

Mozilla Firefox |

136 and above |

136 and above |

|

Vivo Browser |

N/A |

12 and above |

|

HeyTap |

N/A |

45.9.10.0 and above |

|

Opera |

118 and above |

118 and above |

Last Updated on 10 December 2025

How to update your browser

|

Google Chrome: Click on the three dots on the top right corner, select 'Help', then select 'About Google Chrome'. It will automatically check for updates and install them. |

|

Apple Safari: Open the App Store, go to 'Updates' tab and install any available updates. |

|

Mozilla Firefox: Click on the three lines on the top right corner, select 'Help', then select 'About Firefox'. It will automatically check for updates and install them. |

|

Microsoft Edge: Click on the three dots on the top right corner, select 'Help and feedback', 'About Microsoft Edge', then select 'Download and install’. |

|

Huawei: Open the Huawei AppGallery and search for 'Huawei Browser'. If an update is available, tap the 'Update' button to install the latest version. |

Starting 21 October 2023, to better protect your account, a separate daily limit has been introduced for transfers to e-Wallet:

- BigPay

- Boost

- Finexus

- Grab

- Touch n Go

Your default daily limit for transfers to e-Wallet will be RM250 and you can increase this limit up to RM1,000. As this may impact any ‘Recurring Transfers’ you have previously set-up, please ensure you adjust your daily limits via HLB Connect. Here's how:

HLB Connect Online:

Go to ‘Settings’ > Click ‘Change Online Transactions Limit’ > Under ‘Other Bank Transfer’, change your limit at ‘DuitNow to Account (e-Wallet only)’

HLB Connect App:

Tap ‘Menu’ > Tap ‘Account Settings & Limits’ & ‘Transaction Limits’ > Under ‘Transfer’, change your limit at ‘DuitNow to Account (e-Wallet only)’

If RM1,000 daily limit is insufficient for your banking needs, call us at 03-7626 8899 to increase your daily limit up to RM50,000.

Starting 25 June 2024, get alerts when you login to HLB Connect Online with a new browser.

This is designed to protect your account from unauthorised access by notifying you whenever a potentially suspicious login happens.

If you suspect your HLB Connect access has been compromised, activate ‘Emergency Lock’ and contact us immediately at 03-7626 8899.

HLB Connect registration, app setup and username/password reset

How to register for HLB Connect

For registration, you will need your Temporary ID, HLB Connect Code, and either your account number or credit card number.

How to set up HLB Connect App

To set up the HLB Connect App on your device, you will need your HLB Connect Code and Device Activation Code.

Important: Moving to a new phone? Remember to unlink the HLB Connect App from your current device before setting it up on your new one.

Here’s how: Login > Tap on ‘Menu’ > ‘App Settings’ > ‘Device & Notifications’ > ‘Remove’

How To Reset HLB Connect

For HLB Connect access reset, you will need your Temporary ID, HLB Connect Code, and your account number or credit card number.

For Existing HLB Connect App users follow these steps: Enter your ID > enter HLB Connect Code > authenticate with AppAuthorise > enter Account/Card number and existing username for verification > enter your new password

Transacting on HLB Connect

Transferring money overseas for

amount up to RM10,000

You will need the recipient’s name, address,

contact number, bank name & bank account number.

Transferring money overseas for

amount above RM10,000

You will need the recipient’s name, address,

contact number, bank name & bank account number.

Transferring money overseas for cash pickup

You will need the recipient’s name, address &

mobile number to receive cash collection code.